🚀 Bezos blasts off

Plus, a data-driven look at how TikTok decodes your interests!

The Wall Street Journal did a deep dive into the TikTok algorithm through a creative strategy - reporters created 100+ bot accounts and watched what videos they were served over time. Each bot was programmed to have certain interests, and therefore watched and engaged with videos about those topics most frequently.

The main takeaway? The #1 factor was watch time. All of the accounts were initially shown similar, “mainstream” viral content (videos averaging 7M views). But after only one or two hours of watch time, the accounts diverged - the vast majority of future videos aligned with each account’s niche interests.

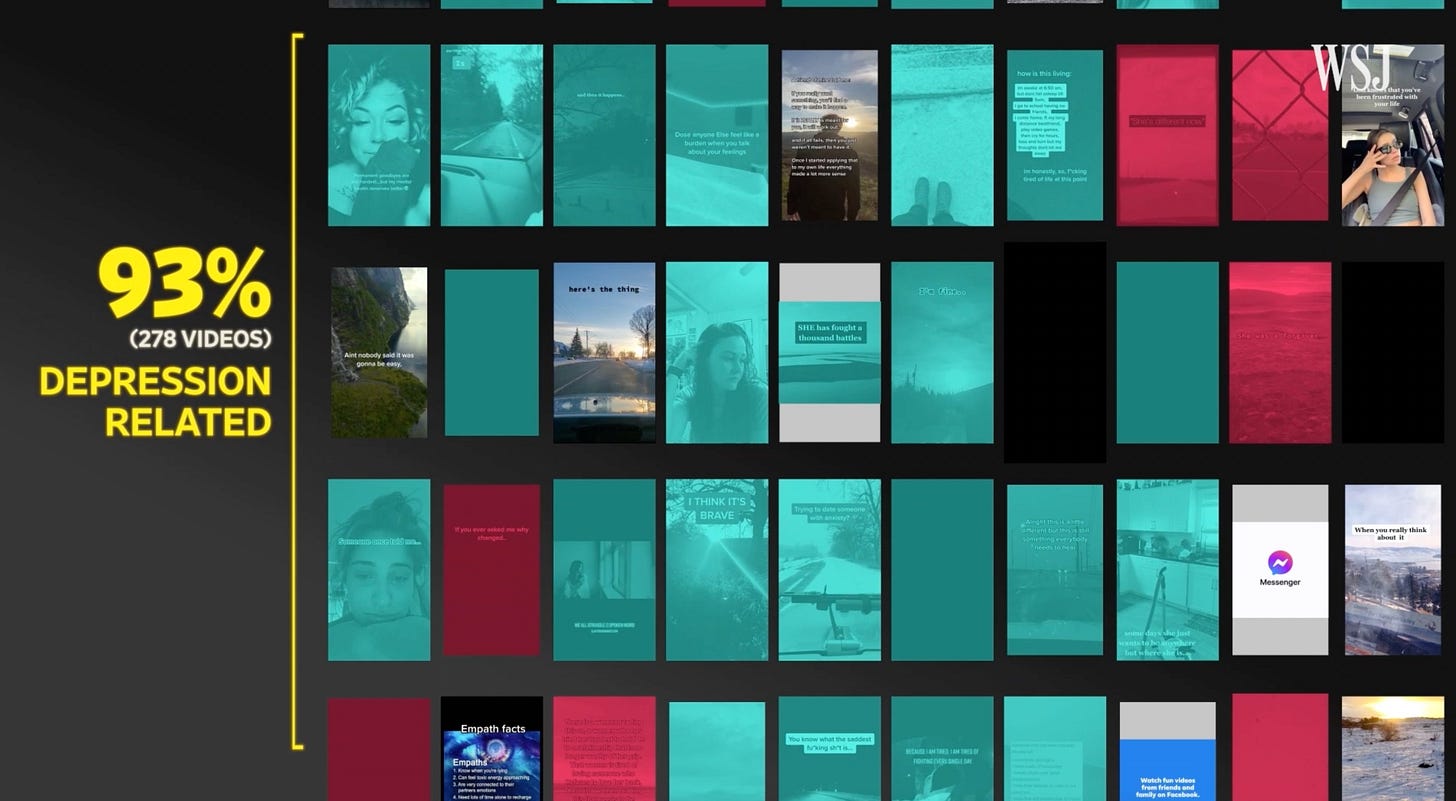

For some users, this is the key to the “magic” of TikTok. If you love soccer, for example, TikTok will serve you up the best game clips daily! However, there’s also a potential dark side. One of the WSJ’s accounts was programmed to spend longer viewing videos about heartbreak. Within 36 minutes, 93% of that account’s For You Page videos were related to sadness or depression.

Every social network struggles with moderation and programming its algorithm. But the problem seems to be more acute on TikTok, as 95% of views come from algorithm-recommended videos (instead of friend or search content). This compares to ~70% algo-recommended views on YouTube, and even less on Instagram and Facebook.

Do you think there should be more scrutiny on the TikTok algorithm?

news 📣

🛵 Rappi raises mega-round. On-demand delivery startup Rappi announced a $500M Series G at a $5.25B valuation. Unless you’ve spent time in Latin America, you’ve probably never used Rappi - it’s a “superapp” that offers everything from food delivery to dog walking to credit cards. The company was founded in Colombia in 2015, and went through YC the following year. Rappi has now expanded to 250 cities across nine countries, and is Latin America’s second most valuable startup (behind Nubank).

📈 Earnings updates. Tech earnings season has officially started! This week:

Snap’s stock climbed after beating expectations for revenue and user growth. Snap now has nearly 300M DAUs (daily active users), who open the app 30 times a day. The company’s market penetration is impressive - 90% of 13-24 year olds in Snap’s five main markets use the app monthly. It still has room to grow in ARPU (average revenue per user), which lags other social networks.

Twitter also had a strong Q2, growing revenue 74% YoY (the company’s biggest growth since 2014). For the first time, Twitter crossed 200M monetizable DAUs, fueled by growth in international markets. The company released a number of new features, including Spaces (audio chatrooms), a monthly subscription for premium features, and tipping.

Netflix had a less impressive showing - despite beating expectations for paid subscribers, it missed earnings estimates. After a blockbuster 2020, the company is now contending with slower growth and heavy spend for new content.

💰 Fundraise features. Funding news is fast and furious lately! I wanted to call out a few rounds that I found particularly interesting:

Investing platform Titan raised a $58M Series B at a $450M valuation. If you’ve been reading Accelerated for a while, you know I’m a longtime fan of what Titan is doing to bring active investing strategies to the next generation of investors. Olivia and I were part of the very first cohort of customers in February 2018 - Titan now has 30K+ users and expects to cross $1B in AUM this year!

Hyper-local delivery app JOKR raised a $170M Series A (!). The company launched just three months ago, and aims to offer nearly instant delivery of groceries and other products from local businesses. Instead of sending shoppers to supermarkets (like Instacart), JOKR procures goods from producers and stores them in its own distribution centers.

Queenly, a marketplace for formalwear, raised a $6.3M seed. The company offers a mix of new and used dresses for pageants, prom, weddings, and more. Queenly’s co-founders are former pageant competitors, and they’re partnering with Miss USA for contestants to list their dresses on the platform.

Jeff Bezos is back in the stratosphere! 21 years after founding spaceflight company Blue Origin, Bezos achieved his lifelong goal of making it to space. He was part of a four-person crew on Blue Origin’s first manned spaceflight.

In a hilarious turn of events, one of the other crew members was an 18-year-old who had never used Amazon. Bezos didn’t hold it against him - he tossed Skittles for the teen to catch mid-flight.

what i’m following 👀

Tomio Geron investigates how Robinhood makes so much revenue per customer.

Five questions with Greylock’s Mike Duboe on e-comm infrastructure (and more!).

Packy McCormick of Not Boring dives into crypto game Axie Infinity.

How did a fitness influencer scale an app that sold for $400M?

This week, YouTube and Tumblr introduced new ways for creators to monetize. YouTube debuted “Super Thanks” (pictured above), a tipping feature for fans to donate $2, $5, $10, or $50 directly on a video. Tumblr launched Post+, a subscription product for creators to put their content behind a paywall (and charge $4-10 per month).

Helping creators monetize is not new to YouTube - this the platform’s fourth feature for fan-to-creator payments. Tumblr is new to the game, as users have historically monetized via affiliate links or ads. The company’s CPO told the WSJ that Post+ came out of the team’s effort to figure out the “hook” to keep Gen Z on the platform.

Last week, I discussed Facebook’s new $1 billion effort to pay creators for content, following in the footsteps of TikTok, Snap, and YouTube. And every week seems to bring new announcements from early stage startups focused on the creator economy! Whether these companies help creators grow their audience, better engage their fan base, or make content more easily, the end goal is the same - financial success.

Will creators shift to creating content for platforms with the best on-platform monetization (as Tumblr seems to believe)? Or will creators post where their content gets the most engagement, and use other tools to make money? It’s a bit soon to make a call, but I have two early thoughts:

Incumbent social networks will become much more acquisitive of creator apps, as they try to offer the “best of both worlds” - a big audience and great monetization opportunities;

We’ll see further bifurcation between mega creators and everyone else! The biggest creators can post their content anywhere and find ways to make money - while the smaller ones may choose platforms with the best built-in monetization for their “1,000 true fans” (e.g. Substack, Patreon, and now Tumblr!).

jobs 🎓

Osmind - Chief of Staff (SF)*

Initialized Capital - Engineering Associate (SF)

Hearth - Junior Growth Associate (SF)

Tonal - Strategy & Corp Dev Associate (SF)

Lithic - Strategic Finance Associate (SF)

Umba - Associate Product Manager (SF)

Zeus Living - Chief of Staff (SF)*

Endeavor - Talent Ventures Associate (NYC)

nate - Biz Ops & Strategy Associate (NYC)

SeatGeek - Business Associate (NYC)

Headway - Product Manager (NYC)*

Hack.Diversity - Partnerships Associate (Boston)

Cometeer - Growth Generalist (Gloucester, Remote)

*Requires 3+ years of experience.

internships 📝

Curated - Data Analyst Intern (Remote)

Snackpass - Product Intern (Remote)

Nikhil Krishnan - Intern (Remote)

Square - Fall Mobile Developer Intern (Remote)

dot.LA - Engagement & Production Intern (LA, Remote)

Amplitude - Territory Ops Intern (SF)

OpenView - Marketing Co-Op / Intern (Boston)

Forage - Content Intern (NYC)

Klarna - Marketing Intern (NYC)

Lolli - Social Media Intern (NYC)

Instabase - Software Eng Intern (NYC)

puppy of the week 🐶

Meet Apollo, a four-year-old Australian Shepherd who lives in Pittsburgh.

Apollo is an adventure dog - he enjoys swimming in pools and lakes, hiking, and even going kayaking!

Follow him on Instagram @apollotheauss!

Hi! 👋 I’m Justine Moore, an early stage consumer & SMB investor. I’m currently Head of GTM at Canal. Thanks for reading Accelerated. I’d love your feedback - feel free to tweet me @venturetwins.