🚀 DOJ seizes billions of Bitcoin

Plus, which company is coming back from the dead?

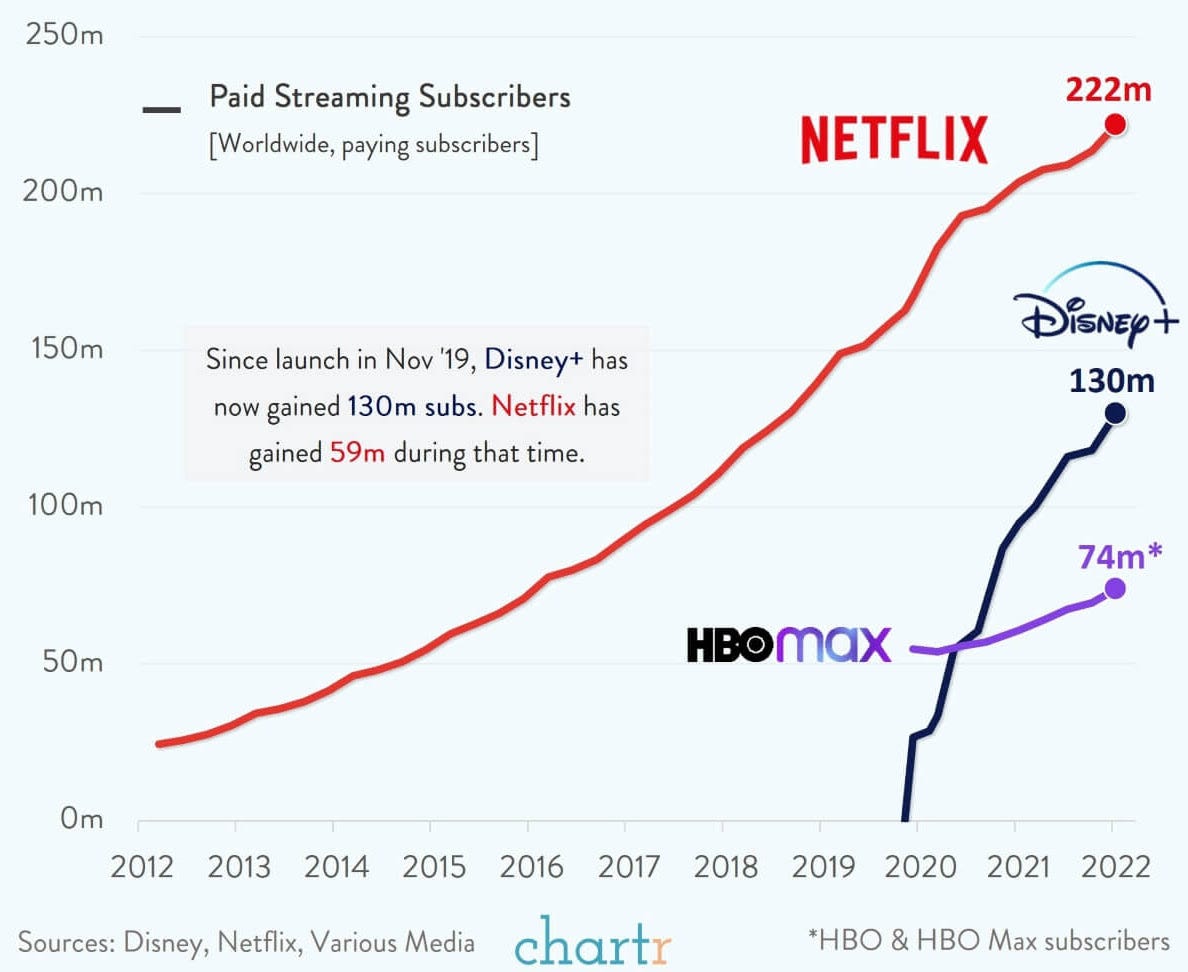

Disney announced earnings this week, beating analysts’ expectations with strong performance across almost all of the company’s business lines. I was particularly impressed by Disney+, which added nearly 12M subscribers despite raising prices.

The graph above (courtesy of Chartr) does an excellent job of illustrating why Disney+ stands out - the subscriber growth looks exponential compared to both market leader Netflix and newer entrants like HBO Max.

In an increasingly crowded streaming landscape, Disney+’s focus on kids & family is a differentiator. Disney not only has the strongest content library for this audience (with 85 years of movies!), but has proven an ability to create new 🔥 content for streaming - like WandaVision, The Mandalorian, and Encanto.

Consumers are getting increasingly frustrated by the fragmentation of streaming services, and I expect to see some consolidation in this space (I’m looking at you, Paramount+). But I see continued growth in Disney+’s future 🔮

news 📣

🚘 Uber bounces back. Uber also reported earnings this week, impressing investors with an 83% YoY increase in revenue. The company’s mobility business is approaching pre-pandemic levels, while delivery continues to see strong growth (and was EBITDA positive for the first time). Uber’s star-studded Super Bowl ad teasers, which highlight the company’s expansion beyond food into other delivery products, are worth a watch - “Uber Don’t Eats” is a catchy slogan.

🚴 Peloton gets a new CEO. It was a rocky week for Peloton. The company announced a plan to cut costs and improve margins, which unfortunately included layoffs of 2,800 employees. Co-founder and CEO John Foley also stepped down - he was replaced by Barry McCarthy, the former CFO of Spotify and Netflix.

If you’re curious about Peloton’s potential path to recovery, I’d recommend checking out this presentation from activist investor Blackwells Capital (though maybe not if you work at McKinsey 😬).

💰 DOJ charges “Crypto Couple.” Remember the 2016 hack of crypto exchange Bitfinex? The Feds arrested the couple allegedly responsible for stealing ~120K BTC (now worth $4.5B), and seized the remaining $3.6B in assets. Ilya Lichtenstein drew attention for being a former YC founder, but I found Heather Morgan more interesting - she’s not only an amateur rapper and TikTok micro-influencer, but also a Forbes contributor. It goes without saying that Netflix is making a documentary about this!

MoviePass has returned from the dead 😲! Founder Stacy Spikes, back at the helm after buying the company in bankruptcy court, announced the re-launch this week.

MoviePass 2.0 has a different vision - Spikes intends to build an “end to end cinematic marketplace powered by Web 3 technology.” It’s unclear exactly what this means (more detail here), but the company is gauging interest in a crowdfunding campaign.

what i’m following 👀

How Bored Ape Yacht Club members are licensing their NFTs.

Bumble made its first acquisition - Gen Z dating app Fruitz!

Why some tech companies are paying candidates for interviews.

Interested in SoCal startups? Check out the California Crescent Fund’s newsletter - it’s a student-run fund investing in student startups.

Biz Carson wrote an interesting profile on Sequoia’s Roelof Botha, covering topics like how he became a public company CFO at 28 and why he almost quit venture.

This week, NFTs landed on two new creator platforms: OnlyFans and PearPop!

OnlyFans’ NFT integration is similar to Twitter’s - creators can add an NFT as their profile picture. But instead of uploading a screenshot, the NFT is verified with a link to the asset’s OpenSea page.

PearPop (a marketplace for creators to match with brands) launched a more complex NFT integration. Pearproof, the company’s new product, allows creators to turn social posts into NFTs. As the post generates more engagement, the NFT “levels up” - giving owners access to special rewards from the creator.

I’m interested to see which web2 social platforms successfully introduce NFTs. On one hand, creators could be an excellent channel for helping crypto go mainstream. The use case is compelling, as I’ve previously written about - many fans feel like they’ve “invested” in a creator, and some spend hours each week (if not more!) engaging in fan communities. NFTs could help them get rewarded for this.

On the other hand, Gen Zers have been significantly less likely than millennials to buy NFTs. They’re concerned with the perceived environmental impact and don’t like the high gas fees. I’ve also noticed a strong cultural distaste among Gen Zers for “crypto bros” - Discord, for example, received a shocking amount of pushback when it hinted at further NFT integrations.

Do you own any NFTs?

jobs 🎓

Cold Start - Ops Analyst (Remote)

First Round Capital - Research Lead* (SF)

Flexport - Biz Ops Associate (SF)

Emerson Collective - Associate, Growth Investing (Bay Area)

a16z - Seed Startup School Program Coordinator (Menlo Park)

Sequoia Capital - Associate, Customer Partnerships* (Menlo Park)

Kingdom Supercultures - Chief of Staff (Brooklyn)

Techstars - Investment Associate (NYC)

Orchard - Associate Product Manager (NYC, Austin)

Zenda Capital - Investment Analyst (Miami)

*Requires 3+ years of experience.

internships 📝

Intern Scale - Software Engineering Interns (Remote) - Intern Scale matches interns with startups in their partner network!

thredUP - Community Marketing Intern (Remote)

Patch - MBA Advanced Analytics Intern (Remote)

Work-Bench - VC Intern (Remote)

Redesign Health - Growth Marketing Intern (Remote)

Flexport - Technical PM Intern (SF)

WhatsApp - MBA Market Specialist Intern (Menlo Park)

Cisco - MBA M&A and Venture Investments Intern (San Jose)

PayPal - Ventures Intern (San Jose)

Moonfare - Strategy & BD Intern (NYC)

Accelerate - Ops Intern (NYC)

puppy of the week 🐶

Meet Luna, a two-year-old Siberian Husky who lives in NYC.

She enjoys playing in the snow, hanging out with her friends at the park, and just generally being a queen 👑

Follow her on Instagram @to.la.luna.and.back!

Hi! 👋 I’m Justine Moore, an early stage consumer & SMB investor. I’m currently Head of GTM at Canal. Thanks for reading Accelerated. I’d love your feedback - feel free to tweet me @venturetwins.