🚀 DoorDash overtakes Uber

Plus, which investment firm is the next Tiger Global?

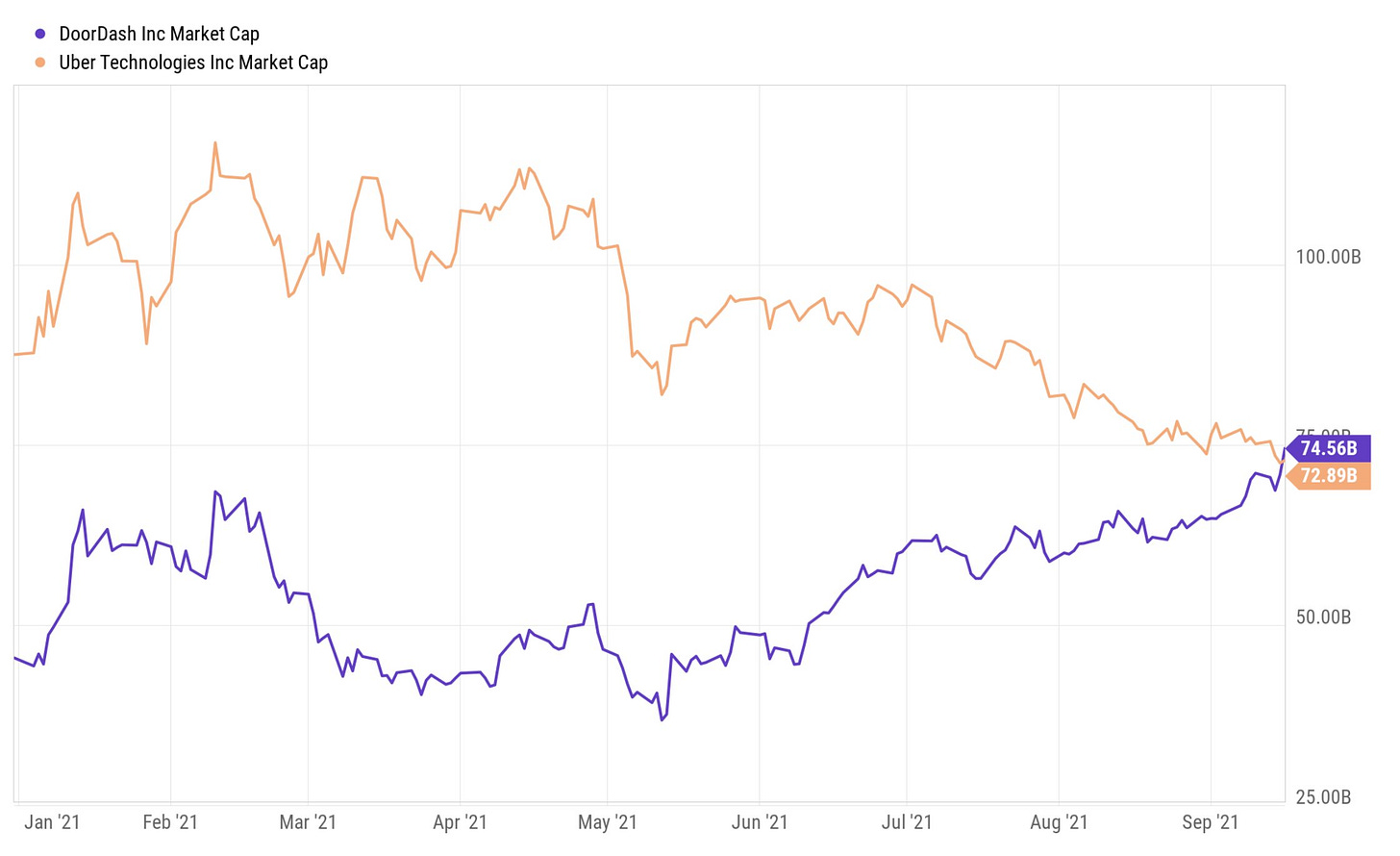

DoorDash hit a new high - and passed Uber in market cap! As of Friday close, DoorDash was worth $75.3B, compared to Uber at $74.9B.

How did this happen? The pandemic has been tough for Uber’s core business (Rides) and Uber’s food delivery business (Eats) has lost ground to DoorDash. SecondMeasure data shows that DoorDash dominates U.S. meal delivery with 57% market share vs. 23% for Uber.

news 📣

✉️ Intuit buys Mailchimp for $12B. In the largest-ever exit for a bootstrapped company, email marketing platform Mailchimp is being acquired by Intuit for $12B. Mailchimp, which is based in Atlanta, was founded in 2001 as a web design agency - the email product was initially a side project! The rest of the company’s story is equally fascinating (remember the viral “Mailkimp” ad on Serial?), I’d recommend this thread if you’re interested in learning more.

💻 Canva raises at $40B. Design platform Canva raised a $200M round at a $40B valuation, becoming the fifth most-valuable private company in the world. Canva has 60M monthly active users and expects to generate $1B in annualized revenue by the end of the year. Many of the features are free, but 500k+ teams pay for premium access. Co-founders Melanie Perkins and Cliff Obrecht plan to give away the “vast majority” of their equity to philanthropy.

🍏 Apple battles bug. Apple hosted its annual iPhone event, announcing the iPhone 13 lineup (featuring upgraded cameras and battery life). However, this launch was somewhat overshadowed by another announcement - Apple was forced to patch a zero-day security flaw that impacted all devices. The flaw allowed hacker groups to infect Mac devices with zero clicks 😬

🔥 Facebook under fire. The Wall Street Journal published “The Facebook Files,” a series of articles that paint an unflattering picture of the company. The articles allege that when internal researchers surface troubling findings - e.g. harassment & abuse policies don’t apply to all users, IG causes major mental health issues for teen girls - their work is largely ignored. FB argues the stories contain “deliberate mischaracterizations,” and that many of the issues raised don’t have a quick fix.

LinkedIn may be shutting down Stories, but the company isn’t giving up on creators! This week, LinkedIn announced a $25M creator fund and a 10-week accelerator that will teach 100 creators to make content.

As a side note - should we be encouraging more people to post content on LinkedIn? It kind of feels like we should be doing the opposite…

LinkedIn will also be testing its Clubhouse competitor in the coming weeks, with the goal of hosting more professional events on the platform.

what i’m following 👀

How Harry’s incentivized referrals to build a 100K email list pre-launch.

Is Coatue the next Tiger Global?

A look at the “fin-fluencers” making bank by promoting fintech products.

How can brands stay relevant in a world where trends cycle overnight?

The parent company of fashion brand Princess Polly filed to go public this week. Princess Polly makes weekend wear for Gen Z women - think of the “Instagram model” aesthetic. You’ve probably also seen their clothes on TikTok!

The brand started in Australia and expanded to the U.S. in 2019, where it’s seen massive growth ($45M—>$125M in revenue in just one year). It’s an impressive story, but not exactly unique. Companies like Shein, Romwe, Fashion Nova, and Cider have all used similar strategies to win over Gen Z consumers.

In the thread ⬆️, I distilled their tactics into a playbook for targeting Gen Z:

Ship fast & often. This isn’t about physically shipping goods (most of these brands are notoriously slow!) - it’s about the frequency of releasing new products / features. Brands like Princess Polly know that it’s hard to predict exactly what will “hit” with Gen Z consumers, so they release hundreds of new products every week and learn from the bestsellers.

Pick a niche. Define your target customer and build the best possible product for them. Trying to make something that pleases everyone is a recipe for disaster. When you study the most successful Gen Z fashion brands, you’ll notice they all have a very clear aesthetic - and it’s often controversial! But their customers love what they make + spread the word.

Find your true influencers. Many brands leverage influencers/celebrities for marketing. And it’s tempting to target those with the most followers! But audience size and engagement aren’t necessarily correlated. Princess Polly works with 10k influencers, but they’re primarily “micro-influencers” - they don’t have millions of followers, but often have strong connections with their audience (and influence their purchasing decisions).

Reduce friction. Gen Z has endless competing demands for their attention - there’s always another app or website. If you make it too hard to sign up for or use your product, you’ll lose them. On the flip side, reducing friction can be a competitive advantage. Princess Polly was an early adopter of Afterpay, which enables consumers to pay in installments. This was particularly helpful for Gen Zers who don’t have much spending money.

Build for mobile. If you’re building a product for Gen Z, invest in a robust mobile site / app over a desktop platform. The majority of Gen Zers spend at least 5 hours a day on their phone - it’s the best place to reach them. 70%+ of Princess Polly’s traffic comes from mobile, and you can tell that the brand’s website is optimized for it!

As a side note - there aren’t nearly enough people digging into the companies and trends that the next generation of consumers care about! If you’re looking to start creating content online, this could be an interesting area to explore. And feel free to send me (email or DM) anything you write - I’d love to amplify it.

A few examples: Packy McCormick’s viral post on Shein, High Tea’s post on how Olivia Rodrigo blew up on TikTok, and my thread on Crumbl Cookies.

Contrary Capital launched Startup Search, a platform to search for internships and new grad roles at top startups.

Applications are now open for Reactor, a new program from Floodgate for student founders.

jobs 🎓

Techstars - Ops & BD Associate (Seattle)

Newfront Insurance - Chief of Staff (SF, Remote)*

a16z - Associate, Capital Network Group (Menlo Park)

Robinhood - Market Ops (Menlo Park)

DCVC - Research Analyst (Palo Alto)

Carvana - Associate Product Manager (LA)

High Alpha - Analyst (Indianapolis)

Panoramic Ventures - Senior Associate (Atlanta)*

Bubble - Growth Associate, Startup Relations (NYC)

Candid - Strategy & Ops Associate (NYC)

Digital Currency Group - Associate (NYC)

Primary Venture Partners - Founder Ops Manager (NYC)

*Requires 3+ years of experience.

internships 📝

Titles - Social Media Marketing Intern (Remote)

Hopper - Data Science Intern (Remote)

TheGuarantors - Customer Success Intern (Remote)

Brex - Summer 2022 Ops Intern (Remote)

AvantStay - Growth Marketing Intern (Remote, LA)

DocuSign - Data Analyst Intern (SF)

Pocket Gems - Summer 2022 PM Intern (SF)

Nationwide - Venture Capital Intern (Columbus)

Shipt - Product Management Intern (Birmingham)

Current - Influencer Marketing Intern (NYC)

Daily Harvest - Growth Marketing Intern (NYC)

puppy of the week 🐶

Meet Koda, a one-year-old Australian shepherd + Husky + Pomeranian mix who lives in Pittsburgh.

Koda enjoys going on walks with his mom, playing with his Barkbox toys, and exploring parks.

Follow him on Instagram @koda_and_cream.

Hi! 👋 I’m Justine Moore, an early stage consumer & SMB investor. I’m currently Head of GTM at Canal. Thanks for reading Accelerated. I’d love your feedback - feel free to tweet me @venturetwins.