🚀 E-comm roll-ups: 2021's hottest trend?

Welcome to the second week of holiday posts! As a reminder - given there’s less news this time of year, I’m covering trends from 2021 and things I hope to see next year. Last week, I shared five things that I got wrong this year.

This week, I thought it would be fun to dive into one specific category: e-comm rollups. I'll share my thoughts on how they work, why they've attracted so much VC interest, and where the key opportunities + risks are.

Overview & funding

If I had to guess which space raised the most VC $ this year (other than crypto!), I’d pick e-comm roll-ups. Almost every week, we saw massive rounds get announced - Thrasio’s $1B Series D, Perch’s $775M Series A, and Elevate’s $250M Series B are just a few examples.

To quantify funding in this space, I identified 65 e-comm roll-up platforms worldwide. Using Pitchbook + Crunchbase, I found funding for 46 - they raised a total of $12.5B (equity and debt) this year. These same companies only raised $1.5B prior to 2021, so this year marked a meaningful increase.

And it’s not just PE funds or growth investors providing this capital - early stage VC funds are getting into the game. Below is data from Pitchbook on the most active venture funds investing in e-comm roll-ups.

What are these companies doing with all this cash? They’re buying e-commerce brands, most of which sell exclusively on Amazon and use Amazon’s fulfillment services (called FBA). These brands focus on (1) deciding what to sell, (2) designing and manufacturing products, and (3) optimizing their listings. Amazon packages and ships the orders, and even manages things like returns and customer service.

NB: We’re starting to see e-comm roll-ups focused on brands operating on other marketplaces (e.g. eBay, Walmart) or that sell direct-to-consumer (primarily Shopify stores). But the majority of volume in this space is concentrated in Amazon brands.

Many brands are run by individuals or small teams, who do an impressive job of growing them - sometimes to millions of revenue. But where do they go next? They have to choose between maintaining organic (but relatively slow) growth, raising $ to scale more quickly, or working with a broker to find a buyer (typically a long & painful process). E-comm roll-up companies offer another option: a quick & seamless sale.

How does it work?

Roll-up platforms are kind of like VC firms - they source deals (brands to acquire) through a number of channels, both inbound and outbound.

Inbound - brand operators who are considering a sale proactively submit their info for review. Most roll-up platforms have a form on their website for this!

Outbound - roll-up platforms hire BD reps who are tasked with identifying interesting brands and reaching out to the operators.

Once a brand is in the pipeline, diligence begins. This process varies by platform, but typically involves a deep dive into financial and operational data, meetings with the team, and vetting the product(s). Most platforms give brand operators an estimated valuation upfront - which allows them to make a more informed decision around proceeding with diligence (or not!).

Roll-up platforms promise a quick and transparent process measured in days, not months. When they dive into a brand’s data, they’re primarily looking to validate the financials and identify any “black hat tactics” - like paying for positive reviews for your own products or negative reviews for a competitor’s products.

After the platform and operator agree to a deal, the process of migrating the brand begins (Benitago has a guide on how this works). The seller also starts receiving payouts on a pre-arranged schedule. Some sellers receive the full value upfront, while others get portions over time - with the ability to earn more (or less) based on the brand’s performance.

What do they look for in brands?

Most platforms are looking to acquire brands with a strong foundation and potential for future growth. This usually manifests in a few characteristics:

Meaningful scale. Varies by platform, but they’re typically seeking $1M+ in TTM (trailing twelve month) revenue.

History of success. Brand has to have 1-2+ years of operating history & financials, with consistent growth.

Profitable. Generally seeking a 10%+ profit margin. This requires both a strong gross margin and reasonable marketing spend.

Category. Most platforms are looking for brands that sell “everyday” products (e.g. cleaning supplies, utensils) and aren’t driven by trends (like apparel).

Strong reviews. Average rating of at least 4 stars - they want products that customers love and will advocate for.

What do they do post-acquisition?

E-comm roll-up platforms are kind of like private equity firms. They acquire brands and improve their operations, with the goal of generating more cash and/or eventually selling them at a markup. Most execute a detailed “playbook” for new brands they acquire, with a focus on growth.

A few examples of the types of things they work on:

Products. Adding new products to meet demand, eliminating poor performers, or improving features to get better reviews.

Presentation. Things like better packaging, a clearer product page, or enhanced photos can make a big difference on conversion.

Pricing. Pricing impacts how your product is perceived and how much you sell - setting prices + updating them is critical.

Distribution. This includes optimizing the brand’s listings on Amazon, investing in paid advertising, or exploring new channels (e.g. retail, D2C).

Part of the pitch for roll-up platforms is using economies of scale to lower costs for each individual brand. Each brand in the portfolio can leverage the platform’s centralized teams for things like finance & accounting, marketing, talent, legal, and even product development.

What I like

Indexing a growing space. In some ways, these platforms are like index funds - their performance should track the growth of third-party sellers on Amazon. And I’m optimistic about this, thanks to a cascade of positive trends: a sizable jump in e-comm penetration (now ~20% of total sales), continued growth in consumer spend on Amazon (see the chart below), and the increasing dominance of third party sellers (50%+ of GMS and climbing).

Unlocking scale. I love the idea of pouring “jet fuel” on promising brands to maximize their performance. As an independent seller, it’s nearly impossible to be an expert at everything - from sourcing and manufacturing to designing product pages to working the Amazon algorithm. I can see how a platform that allows brands to leverage shared, best-in-class resources (and teams of experts!) should be able to unlock meaningful growth while reducing costs.

De-risked business model. The $ pouring into this space might seem crazy. But this business model is less risky than other capital intensive VC-backed categories like co-working, scooters, and ultra-fast delivery. These brands not only have positive unit economics, they’re already profitable and are clear candidates for multiple arbitrage (more below). As a result, it’s hard to see a scenario where they lose money - but they may have a more capped upside.

What I worry about

Competition driving up brand prices. The success of platforms like Thrasio has inspired dozens of well-funded competitors, creating a “feeding frenzy” around brands (sound familiar to any VCs?). A Thrasio post notes that while brands used to sell for 2x EBITDA, they now trade at 3-6x+. With more $ in this space, these multiples will continue to climb. Roll-up platforms don’t (yet) sell the brands they acquire, but their portfolio EBITDA will be valued upon exit (IPO or M&A) - it’s important they aren’t “overpaying” for brands if they want to generate a strong return.

Dependence on Amazon. Most roll-up platforms acquire brands that sell on Amazon, making them heavily reliant on one distribution channel. This comes with risk - changes in Amazon’s search algorithm could cause sudden and serious drops in product visibility and performance. Amazon has also been found to use data from successful third-party sellers to develop copycat products at lower prices 😬. And most brands don’t get basic info on their customers (e.g. email address) to retarget them for repeat purchases.

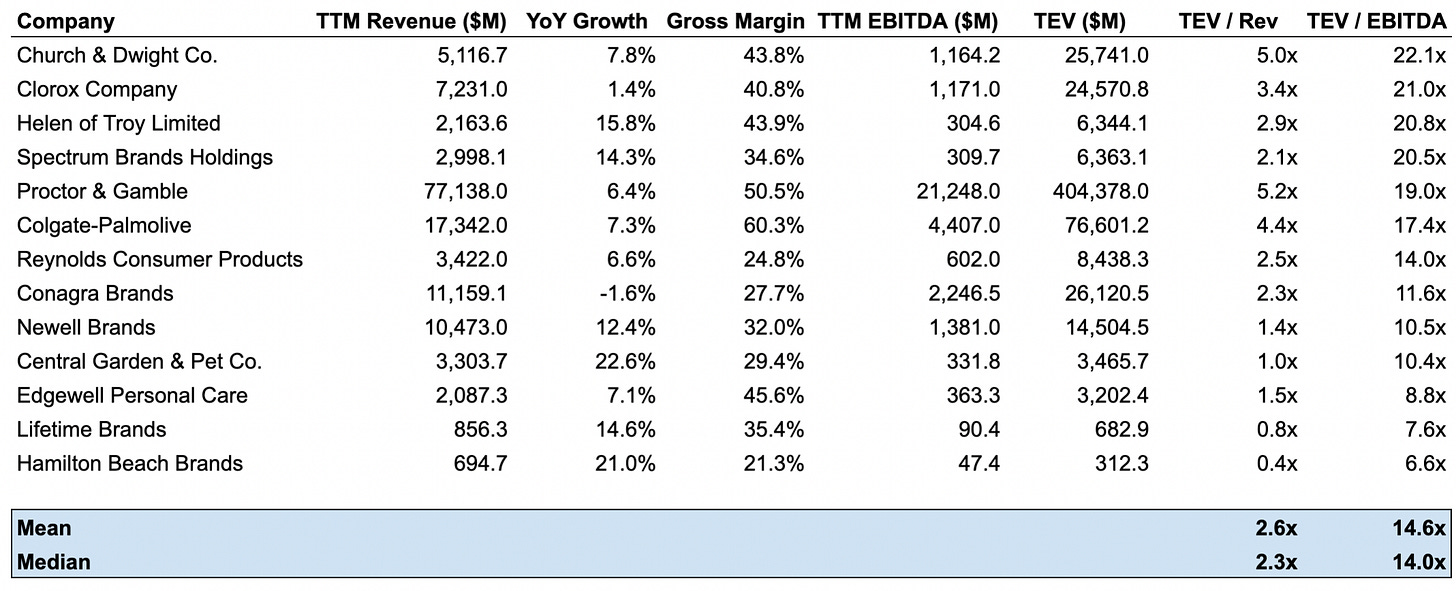

Exit opportunities + public comps. The end game for roll-up platforms is still TBD. M&A is one option, but it’s unclear who the natural acquirers are - maybe traditional brand holding companies (e.g. P&G, Clorox, Colgate-Palmolive) that are looking to further diversify into e-commerce?

Going public is also an option for roll-up platforms that achieve meaningful scale. Many of the public comps trade at a premium to the multiples at which platforms acquire individual brands (look at the TEV / EBITDA column vs. the 3-6x mentioned above). This can be explained by the principle of multiple arbitrage - companies with larger revenue scale tend to get higher multiples, all else equal. However, they still aren’t valued like tech companies!

Areas for future growth

This space will further evolve - here’s a few trends I’m keeping an eye on:

Moving beyond Amazon. Early e-comm roll-ups focused on FBA (fulfilled by Amazon) brands. There are benefits to this - Amazon provides a way to reach millions of consumers every day, and the logistics & fulfillment services make it easy to sell products without worrying about operations. But there are also downsides. New companies in this space, like OpenStore, are targeting true D2C brands (which often operate on Shopify) - they have their own websites, allowing them to collect customer data and giving them more control over branding + customer experience.

Tackling supply & fulfillment. Especially as roll-up platforms expand beyond Amazon, I expect to see them make moves in supply chain and distribution to unlock additional savings. They have a unique ability to buy raw materials and manufacture products in bulk (aggregating demand across their brands). Same goes for shipping and fulfillment - the costs of storing, shipping, and returning products add up quickly, so discounts here are meaningful.

Launching consumer-facing sites. As far as I’ve seen, no roll-up platform has a consumer-facing site for shoppers to buy products across all their brands. This presents a new set of challenges, mostly around customer acquisition. How do you convince consumers to buy from you instead of Amazon? But there are advantages of “owning” the consumer - you can do things like cross-selling products, offering subscriptions, and collecting data for retargeting. I wouldn’t be shocked to eventually see a Thrasio marketplace.

That’s it from me! If you’ve spent time in this space, I’d love to hear from you - do you agree or disagree with this analysis? What did I miss? Feel free to respond to this email or tweet me @venturetwins.

jobs 🎓

Rupa Health - Growth Analyst (SF, Remote)

Faire - Marketplace Success Specialist (SF)

Patreon - Product Manager (SF)*

Parafin - Biz Ops & Strategy Lead (SF)*

Goodwater Capital - Investment Associate (Burlingame)

Techstars Music - Ops Associate (LA)

Equal Ventures - Insurtech/Fintech Associate (NYC)

Good Dog - Product Manager (NYC)

Forum Brands - Product Launch Analyst, Strategic Associate (NYC)

Titan - Investment Writer, Product Manager* (NYC)

IndieBio - Partnerships & Program Lead (NYC)

*3+ years of experience required!

internships 📝

LinkedIn - Product Design Intern (Remote)

Vetcove - Business Intern (Remote)

Thingtesting - Social Media Intern (Remote)

Atomic - Product & Engineering Interns (Remote)

Addepar - Community Marketing Intern (Remote)

MasterClass - PM Intern (SF)

Braze - Customer Success, Data & Analytics Interns (SF, NYC)

Pinterest - Product Analyst Intern (SF)

Audible - MBA Acquisition Intern (Newark)

Rent the Runway - Revenue Growth Intern, Diversity Launchpad (NYC)

Hi! 👋 I’m Justine Moore, an early stage consumer & SMB investor. I’m currently Head of GTM at Canal. Thanks for reading Accelerated. I’d love your feedback - feel free to tweet me @venturetwins.