🚀 Fleets, we barely knew you

Plus, the UK crowns a new startup king!

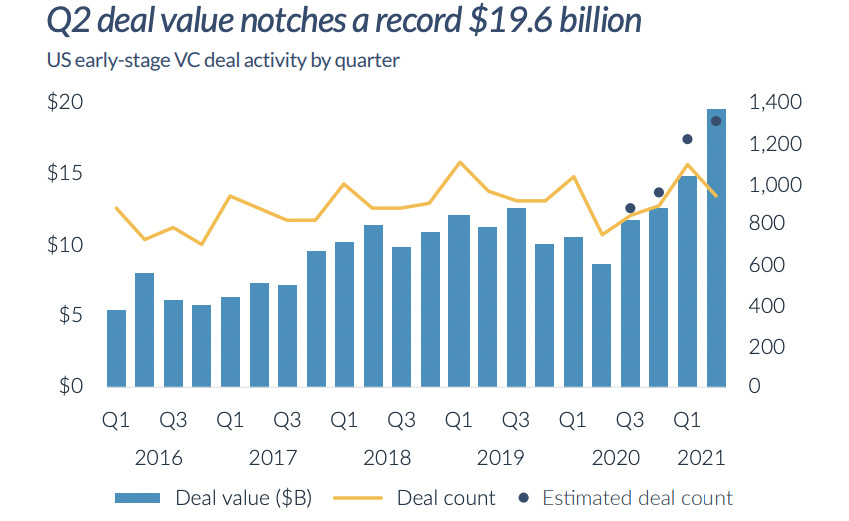

Pitchbook and the NVCA released their quarterly Venture Monitor - unsurprisingly, deal activity in H1 2021 broke records! The graph above illustrates the uptick in Series A and B rounds, but the trend holds across stages. A few takeaways:

The definition of “early stage” investing has shifted. Thus far in 2021, ~50% of early stage rounds were $10M+, compared to <25% in 2016. The average early stage check is $20.5M, and the average pre-money valuation is almost $100M. This is up from an average $15.6M round size and $62M valuation in 2020.

Late stage rounds continue to soar. Growth stage rounds totaled ~$110B in H1 2021, topping deal value for the entirety of 2020! This is largely driven by the rise of mega-rounds ($50M+), which comprise 83% of late stage deals.

Companies with female founders raise less $. In H1 2021, 25% of investments (by number) were in startups with at least one female founder. However, only 16.3% of deal value (by $) went to these startups.

Micro-funds hit a record low. $1B+ funds are becoming mainstream - they accounted for ~50% of VC $ raised in H1 2021. Meanwhile, the share of micro-funds (both # and $ value) declined, as first-time fundraising has been sluggish.

news 📣

💸 Facebook courts creators. In an era when seemingly every other* social app is incentivizing creators with monetary rewards, Facebook is finally getting with the times! Mark Zuckerberg announced this week that the company plans to pay out $1B by the end of 2022. A pilot group of creators will be compensated for making Reels, hitting milestones on IG Live, and enabling ads on IGTV videos. Facebook payments will come later in 2021, and will also be focused on video - streamers can earn based on how many other users send them tips.

*TikTok launched a $200M Creator Fund last year, YouTube announced a $100M fund for Shorts, and Snap pays creators $1M per day for Spotlights.

🇬🇧 Revolut tops UK startups. Neobank Revolut announced an $800M round at a $33B valuation, making it the UK’s most valuable startup! This valuation represents a 6x markup in the last year. The company’s “superapp” is a one-stop shop for banking, investing, money transfer, and more, and it’s used by 16M consumers to make 150M+ transactions/month. Revolut will be using this round to add new features (e.g. insurance, credit) and continue to scale its user base in newer markets like the U.S. and India.

🛍️ E-comm rollups gain steam. It was a big week in the e-commerce rollup space! As a reminder, these companies purchase brands that sell on platforms like Amazon and help them scale their operations (and get higher margins!). You may be familiar with Thrasio, the fastest company to reach unicorn status - many other startups are hot on its tail, as evidenced by the funding rounds announced in the past week alone:

Elevate Brands raised $250M to grow its portfolio of 25 brands.

OpenStore (Keith Rabois’ new company) raised a $30M Series A.

📈 SPAC & IPO roundup. There were also lots of updates here! A few to highlight:

Blend IPO’ed on the NYSE at a ~$4B market cap. The company’s software enables financial services firms like Wells Fargo to process $5B in consumer loans and mortgages every day.

Autonomous vehicle company Aurora will go public via SPAC at a ~$13B valuation. You may remember Aurora from its $10B acquisition of Uber’s self-driving unit late last year!

ServiceMax, a SaaS company for field service technicians, will go public via SPAC at a $1.4B valuation. This is ServiceMax’s second chance at an exit - the company sold to GE for almost $1B in 2016, but spun out in 2018.

After a short eight months of life, Twitter is saying goodbye to its ephemeral stories feature, Fleets. Fleets was built to encourage less active Twitter users to post more, but VP of Product Ilya Brown said that the main use case was frequent tweeters amplifying their own content 😂

Fleets will officially disappear on August 3, but this isn’t the end of Twitter’s experimentation! The company will add some of Fleets’s popular media features (e.g. GIF stickers, full-screen camera) to the main product, and Brown said that Twitter will continue to try “bigger, bolder things to serve the public conversation.”

what i’m following 👀

MSCHF dropped a collection of “dead startup toys.”

Lenny Rachitsky recaps the different ways labor marketplaces kickstart supply.

A look at how the photo dump took over Instagram.

Netflix will reportedly start offering video games on its platform.

BNPL (buy now, pay later) company Klarna announced this week that it’s acquiring Hero, a startup that brings the IRL shopping experience to online stores.

Imagine you own an apparel brand with a few brick-and-mortar stores and an e-comm site. When prospective customers come to your physical stores, your sales associates greet them, ask them what they’re looking for, and make recommendations. But when shoppers visit your store online, they end up browsing countless pages of inventory by themselves, with no one to answer their questions or help them choose what to buy.

As a result, conversion (% of visitors who make a purchase) tends to be very low online - it’s generally ~2%. Hero helps brands convert more customers by enabling them to communicate directly with online shoppers through livestreams or 1:1 virtual shopping sessions. The company has 200+ customers, from legacy brands like Levi’s and Nike to newer players like Allbirds and UNTUCKit. Hero claims that customers who interact with the platform are 21x more likely to buy and spend up to 70% more!

The acquisition announcement didn’t get much attention this week, probably because the price was rumored to be relatively low. However, if you’ve followed the livestream shopping market, this is an interesting development! Buzzy startups like Whatnot and Popshop Live have focused on enabling individuals and small businesses to become livestream sellers. Hero is tackling an entirely different segment (enterprise-scale brands), but further validates the consumer demand for more interactive shopping!

Applications are open for the Susa Venture Fellows program - check it out if you’re an aspiring VC!

jobs 🎓

Mercury - Ops for Raise (Remote)

Basis Set Ventures - Chief of Staff (Remote)

Stytch - New Grad Software Engineer, Product Manager* (SF)

Chime - Product Manager (SF)

Faire - Product Analyst (SF)

500 Startups - Investment Associate (SF)

Initialized Capital - Associate (SF, NYC)

Unusual Ventures - Research Associate (Menlo Park)*

Redesign Health - Founding Chief of Staff (NYC, Remote)*

Citi Ventures - Senior Associate/VP (NYC)

BDMI - VC Analyst (NYC)

Temasek - Consumer Investment Associate (NYC)

Nomad Health - Associate Product Manager (NYC)

*Requires 3+ years of experience.

internships 📝

Drift - Editorial Intern (Remote)

Zendesk - Design Program Intern (Remote)

App Annie - Product Marketing Intern (Remote)

Hellosaurus - Data Analyst Intern (Remote, NYC)

Wave.tv - Snapchat Intern (LA)

Choco - City Launch Sales Intern (LA)

LTK - Creator Success Intern (Dallas)

Baublebar - Product Dev Intern (NYC)

Dataiku - Biz Ops Intern (NYC)

Laika - Platform Partnerships Intern (NYC)

puppy of the week 🐶

Meet Zero, a ten-year-old corgi who lives in SoCal.

Zero enjoys swimming in her pool (and sometimes chilling on a pool float), running around at the beach, and celebrating Halloween - she’s a pumpkin queen.

Follow her on Instagram @corgi_zero!

Hi! 👋 I’m Justine Moore, an early stage consumer & SMB investor. I’m currently Head of GTM at Canal. Thanks for reading Accelerated. I’d love your feedback - feel free to tweet me @venturetwins.