🚀 Has YC lowered its bar?

Plus, why a drop in valuation can help a startup's employees...

news 📣

🛒 Instacart slashes valuation. In an unusual move, Instacart cut its own valuation from $39B to $24B (a 40% drop!). Why? As public tech stocks have struggled this year, the company feels this valuation is more in line with comps and will help recruit & retain employees. This may seem counterintuitive, but at Instacart’s stage, a lower valuation = more attractive equity packages for new hires. As Instacart approaches an IPO, employees see more potential upside if their equity is issued at a lower price.

🎮 Crypto game suffers massive hack. Ronin Network, the blockchain behind crypto game Axie Infinity, announced the second-largest crypto hack in history this week. The hack took place in late March, when attackers found a backdoor through the network and withdrew 173K ETH and 25.5M USDC. COO Aleksander Larsen said that the company is “fully committed” to reimbursing players who lost funds. The Ronin coin ended the week down 20% on the news.

🦄 Chief becomes a unicorn. Chief, a private executive network for women, reached a $1 billion valuation with a new $100M round led by CapitalG (Google’s venture growth arm). The company has more than 12,000 members across 8,500 companies, who pay for access to a network, events, and a coach-facilitated core group of female execs. Chief launched in 2019 with a physical clubhouse in NYC, and expanded nationwide via a digital program this year.

In a world of brands posting boring and uninspired content for April Fools’ Day, be a Duolingo. The mental image of the company’s giant owl mascot body checking someone into a white van is not something that I will quickly forget.

Runner up status goes to Twitter, which kept it short and sweet.

what i’m following 👀

Ten tips from startups crushing it on TikTok.

The Web3 creator economy: a primer and market map.

How nostalgia and BookTok are bringing back brick-and-mortar bookstores.

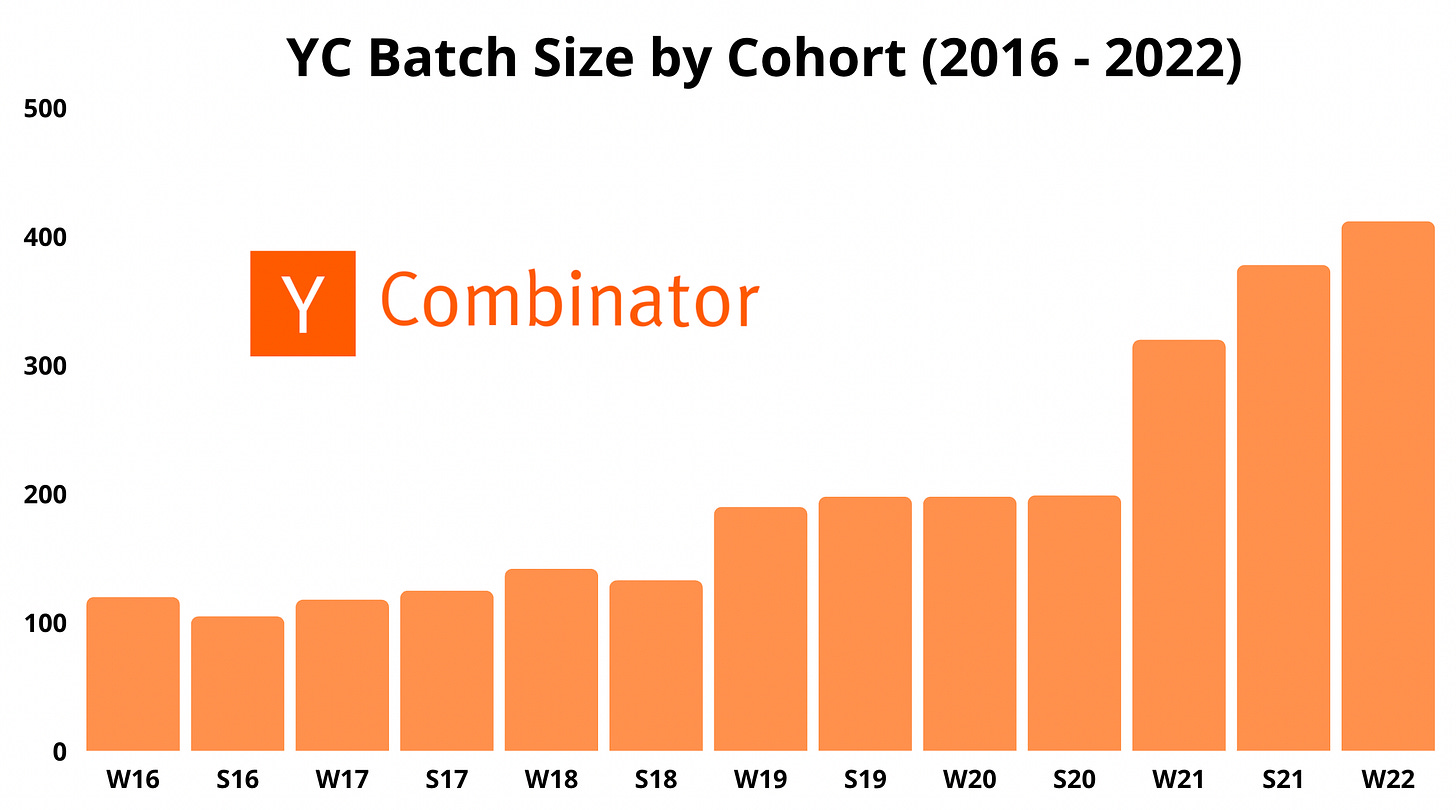

This week, YC’s Winter 2022 batch debuted at Demo Day. With 414 startups, this was YC’s largest class yet!

There’s been a lot of discussion around whether YC is experiencing brand dilution as class sizes continue to climb. The average batch size doubled in the four years between 2016 and 2020, from ~100 to ~200 companies - and then doubled again in just a year, from 198 in Summer 2020 to 414 in Winter 2022.

What’s driving this? A big part of the first “wave” of expansion (2016 - 2020) was YC going international. YC partners Michael Seibel and Qasar Younis initiated a global tour in 2016 to attract startups worldwide, and non-U.S. representation climbed to ~40% of the average batch by the end of 2020, and 50% of this batch (W22).

The bigger shift, however, seems to be going remote. S20 was the program’s first remote batch (as a result of COVID) - partner Michael Seibel said that the YC team built “a lot of software” to run the program digitally. They completed 50% more individual and group office hours than in prior years, and the remote Demo Day outperformed “many” of the in-person Demo Days from years prior.

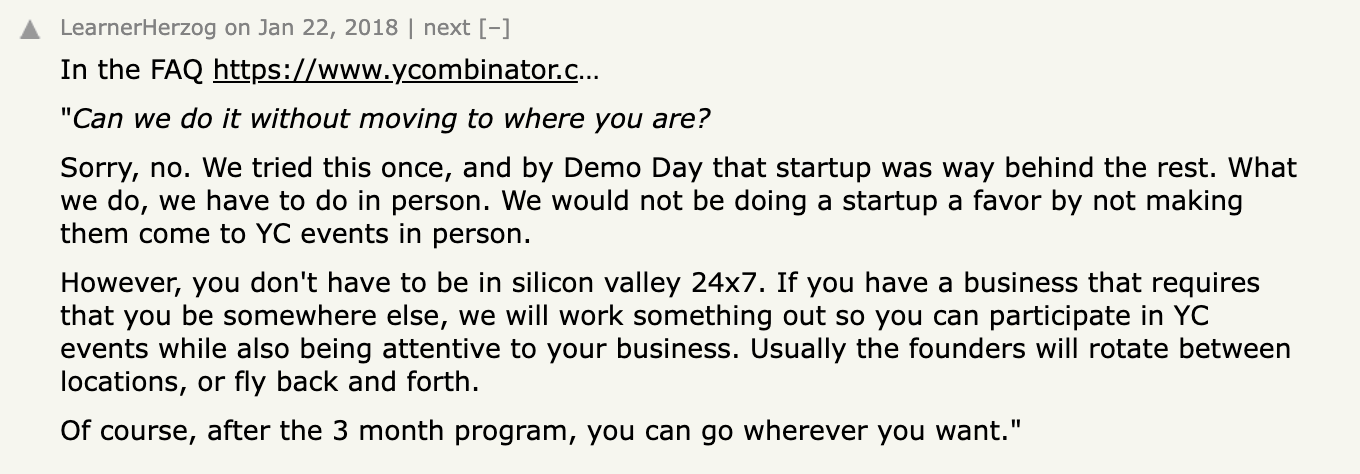

Perhaps more importantly, being remote relaxed a major restriction. YC used to require all companies to move to the Bay Area for the duration of the batch. As you can see from the screenshot below, they argued that the program simply didn’t work remotely. But as the commentary indicated, some founders either didn’t want to come to the Bay Area or it wasn’t feasible for them - and likely didn’t apply.

After the first successful remote cohort, the batch size jumped 61% between S20 and W21 - the largest increase in YC’s history. It seems unlikely that the growth will stop, as YC President Geoff Ralston said at the end of 2021 that he could envision a 1,000-company batch in the not too distant future. The YC team has become “super efficient” via remote work, and may never return to an in-person program.

This batch saw a 2.4% acceptance rate, just above YC’s historical average of 1.5-2%, so it doesn’t feel fair to say the program has meaningfully “lowered the bar” in terms of quality of companies admitted. YC may have maintained its historical standards and still seen a big jump in batch size, simply due to growth in # of applications. It’s easier than ever to start a company, and the program has made a significant effort to attract companies from new geographies.

What does this mean for the YC brand? It may still be TBD. I’d argue that YC used to be seen as more exclusive, but that’s not necessarily a good thing. Great companies are increasingly founded everywhere, so it makes sense to expand. But as YC becomes “for everyone,” new programs may gain market share in the niches - e.g. Launch House for younger founders, and Chapter One Studios in crypto.

Has YC’s brand changed as the batch size has increased?

📈 Yes - the brand has improved

📉 Yes - the brand has deteriorated

🤷🏽♀️ Not sure

jobs 🎓

Coinbase - Associate Product Manager (Remote)

Spark Capital - Venture Ops (SF, NYC)

Local Kitchens - Strategy & Ops (SF)

Altamont Capital Parters - Analyst (Bay Area)

Seel - Product Analyst (Bay Area)

Correlation Ventures - Investment Associate (Bay Area)

Redbud Brands - Investment Associate* (Austin)

Greycroft - Financial Ops Analyst (NYC)

DoorDash - Senior Associate, Finance & Strategy* (NYC)

XRC Labs - Analyst (NYC)

OpenStore - Strategic Finance & Planning Associate (Miami)

*Requests 3+ years of experience.

internships 📝

Hipcamp - Ops Intern (Remote)

Outlander - Venture Ops Intern (Remote)

Box - GTM Intern (Remote)

Osmind - MBA Strategy & Partnerships Intern (Remote)

Foursquare - PM Intern (Various)

Joro - MBA Product Strategy Intern (Remote)

Canal - Strategy & Ops Extern (SF)

a16z - Community Intern (Menlo Park)

Ritual - Impact Intern (LA)

Morning Brew - Growth Marketing Intern (NYC)

Gympass - Interns (NYC)

puppy of the week 🐶

Meet Odin, a nine month-old Australian Mountain Doodle who lives in NYC.

His hobbies include playing in the snow, training in agility classes, and hanging out with his cat siblings.

Follow him on Instagram @odin.dogofdoodles!

Hi! 👋 I’m Justine Moore, an early stage consumer & SMB investor. I’m currently a student at the Stanford GSB and Head of GTM at Canal. Thanks for reading Accelerated. I’d love your feedback - feel free to tweet me @venturetwins.