🚀 That time when FB broke the Internet...

Plus, a big week for consumer startup S-1s 👀

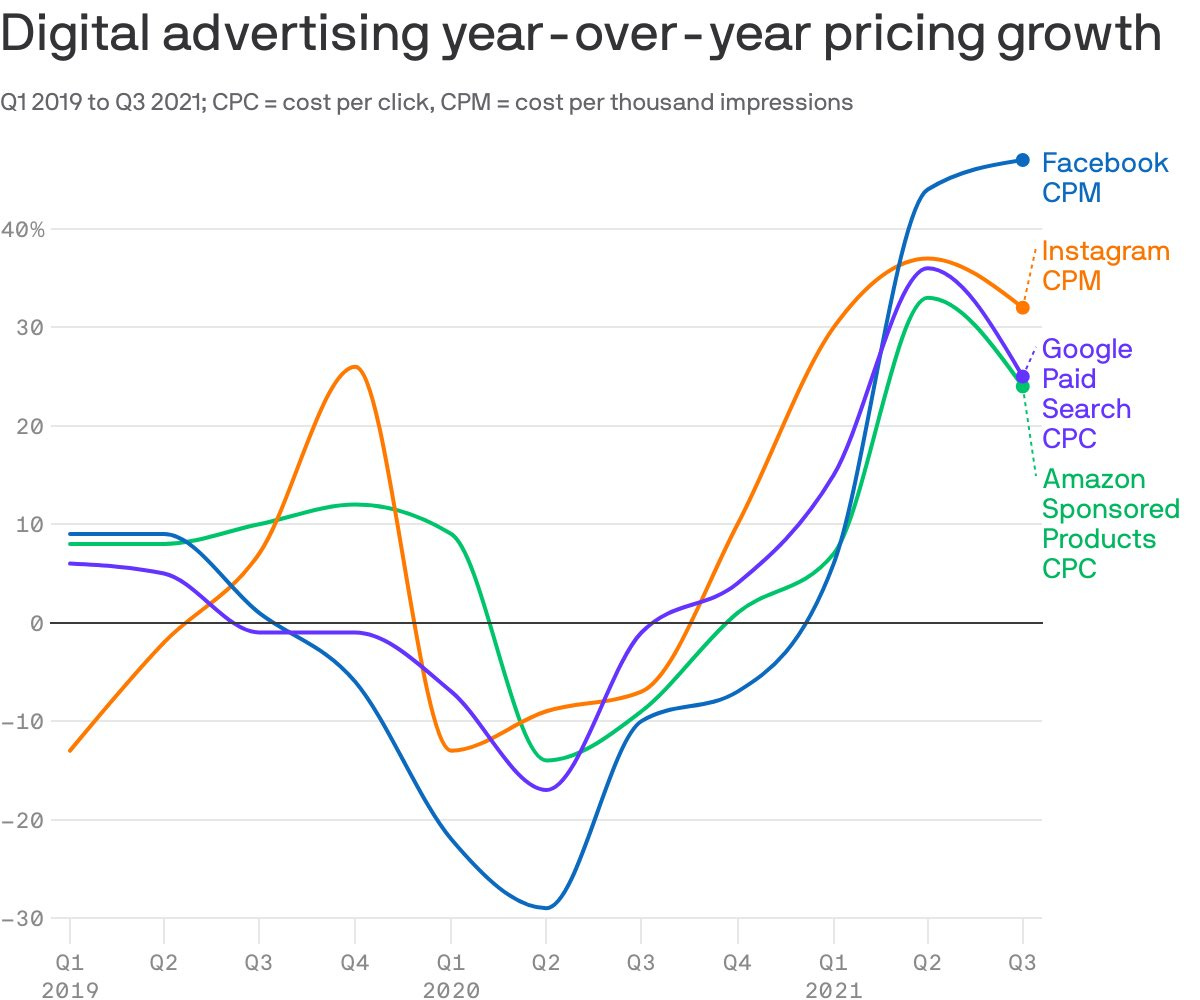

If you’ve spent any time in the e-commerce space, you’ve probably heard that CACs (customer acquisition cost) are rising rapidly for many brands. You can see this in the graph above - over the past year, we’ve seen an enormous increase in the cost of reaching a user across Facebook, IG, Google, and Amazon.

What’s causing this? These marketing channels are very saturated, with many brands trying to reach the same consumers (more competition = higher prices). And recent iOS updates make it harder for brands to track and retarget prospective customers, which makes ad spend less effective.

What can brands do in response? Find new channels that are less crowded - many brands are testing out TikTok, podcasts, and referral programs. And this week, we officially unveiled what we’re building at Canal! Our platform allows D2C brands to unlock new distribution through other brands (and eventually the creators/experts that consumers already know & trust).

We just announced our seed round, led by a16z and Forerunner. If you’re interested in this space, we are hiring - check out our open roles here.

news 📣

❌ Facebook outage rocks the Internet. On Monday, Facebook and its family of apps (Messenger, Instagram, WhatsApp) were down for a stunning six hours, the longest outage in company history. The issue was reportedly caused by an update to the routers that coordinate network traffic (more details here if you’re interested!).

This not only cost Facebook $50-100M in ad revenue, it also disrupted hundreds of thousands of companies that operate on its platform - from e-commerce sites to local small businesses. The only bright spot may have been the incredible memes and humor that emerged on Twitter, which became the only place for the “chronically online” to communicate.

🛒 Rent the Runway files to IPO. It’s been a tough 18 months for clothing rental startup Rent the Runway, according to its new IPO filing. The company’s active subscribers fell 60% in 2020, which is unsurprising given that many people used the service to rent designer dresses for big events. Rent the Runway has high fixed costs, and Maveron’s Jason Stoffer calculated that it would need to 4x revenue in order to break even (check out his full S-1 teardown here). There are some bright spots, notably the company’s high organic acquisition (88%) and growing product margin - but investors will be betting on a significant post-COVID rebound!

💸 NerdWallet preps for public debut. Personal finance company NerdWallet also publicly released its S-1 this week! NerdWallet is primarily a lead generation service for financial products - it helps consumers find credit cards, insurance, personal loans, and more (and makes money from the companies that provide these products). The company’s revenue growth dropped meaningfully during COVID, but it started to see a rebound in the first half of 2021. More in this teardown from John Street Capital.

what i’m following 👀

The second edition of Olivia’s newsletter, Launched, is out! She covers Canva’s launch - it’s a fascinating 5-year journey that started with printing high school yearbooks.

Twitter is going to flag conversations that are “heated” or “intense.”

Vice investigates a multi-million $ NFT scam.

Snap is trying to crack down on people using its app to sell illicit drugs.

Thingtesting dives into the rise of D2C telemedicine startups that prescribe medications online.

I’m going to be honest with you - I’m struggling to keep up with school + startup life + writing this newsletter alone!

To make it a bit easier, I may start featuring great content from others in this section, beginning with this thread on what the Twitch leak revealed about creator monetization on the platform. For context - hackers got access to all of Twitch’s internal data, including payouts to each creator, and published it online. Click through ⬆️ to read the rest.

jobs 🎓

Lightspeed - Consumer Investor (Bay Area, Remote)*

Village Global - Analyst/Investment Ops, Chief of Staff (SF, Remote)

Modern Treasury - Masters/PhD Software Engineer (SF, NYC, Remote)

Pioneer Square Labs - Business Lead (Seattle)

First Round Capital - GM, Angel Track (SF)

Human Capital - Chief of Staff, Principal (Early), Principal (Growth) (SF)

Front - Product Analyst (SF)

Kapor Capital - Principal (Oakland)*

a16z - Fund Strategy Associate (Menlo Park)

Aurora - Product Strategy Associate (Mountain View)

Pikup - Associate Product Manager (Minneapolis)

Imaginary Ventures - Junior Associate (NYC)

*Requires 3+ years of experience.

internships 📝

Modern Treasury - Winter 2022 Software Engineering Intern (Remote)

Atomic - Social Media Intern (Remote)

Kyte - Biz Ops & Strategy Intern (Remote)

Reach Capital - Crypto Intern (Remote)

DocuSign - MBA Product GTM Strategy & Ops Intern (SF)

Slack - Software Engineering Intern (SF)

Lyft - Economist Intern (SF)

Instagram - AR Design Prototyper Intern (SF)

Apple - Business, Marketing, G&A Interns (Cupertino)

Prose - Fall/Winter Data Analyst Intern (NYC, Remote)

ZX Ventures - Summer MBA Investment Intern (NYC)

puppy of the week 🐶

Meet Oatie, a 2.5-year-old Brindle French Bulldog who lives in LA.

He enjoys playing with his golden retriever brother and doing merch drops. He’s also workshopping some Halloween costume ideas, as you can see in the right photo.

Follow him on Instagram at @oatiemeal!

Hi! 👋 I’m Justine Moore, an early stage consumer & SMB investor. I’m currently Head of GTM at Canal. Thanks for reading Accelerated. I’d love your feedback - feel free to tweet me @venturetwins.