🚀 What's going on with DoorDash?

Plus, we're in LA!

Some news from us - after almost a decade in the Bay Area, we’re spending the summer in LA! 🌴 If you’re building, working at, or investing in early stage startup(s), we’d love to meet you. DM us at @omooretweets and @venturetwins.

trending 📈

🤝 Twitter tests CoTweets. If you’ve been on Twitter in the last week, you may have seen some unusual posts that appeared to come from two accounts at the same time. Twitter is officially testing CoTweets, a “limited time experiment” where two users can co-author a tweet together. The feature is only live for a subset of users in the U.S., Canada, and Korea - please support our plea for access!

🛑 Musk terminates Twitter deal. Elon Musk terminated his agreement to acquire Twitter, according to an SEC filing. The filing claims that the company made “false and misleading” claims and didn’t provide data needed to quantify spam & bot accounts on the platform. Twitter has consistently argued that these accounts represent <5% of DAUs, but Musk believes it is “wildly higher.” The company’s board chair tweeted that they plan to pursue legal action to enforce the acquisition.

🩸Theranos trials continue. Sunny Balwani, the former COO of Theranos, was convicted on 12 fraud charges last week. Balwani was found guilty of defrauding both investors and patients - a contrast to founder and CEO Elizabeth Holmes, who was only found guilty of defrauding investors (her trial wrapped up in early January). Both Balwani and Holmes now face up to 20 years in prison.

🥡 Amazon and Grubhub team up. Amazon is getting back into food delivery (more here on its past attempt) through a new partnership with Grubhub. All Amazon Prime members in the U.S. will now get a one-year subscription to Grubhub+, which offers free delivery on orders over $12 at hundreds of thousands of restaurants.

Amazon will get to purchase ~2% of Grubhub at a negligible price, as well as warrants to buy another 13% if the company hits certain performance targets. Grubhub is currently owned by Just Eat Takeaway, a European-based food delivery platform that is facing calls from activist investors to re-focus on its core market.

what we’re following 👀

How Illumination created a viral moment with the new Minions movie.

B8ta’s founder on what hasn’t worked in the D2C brand wave.

The New York Times talks to the top global players of GeoGuessr.

LA Tech Week registrations are open - sign up here!

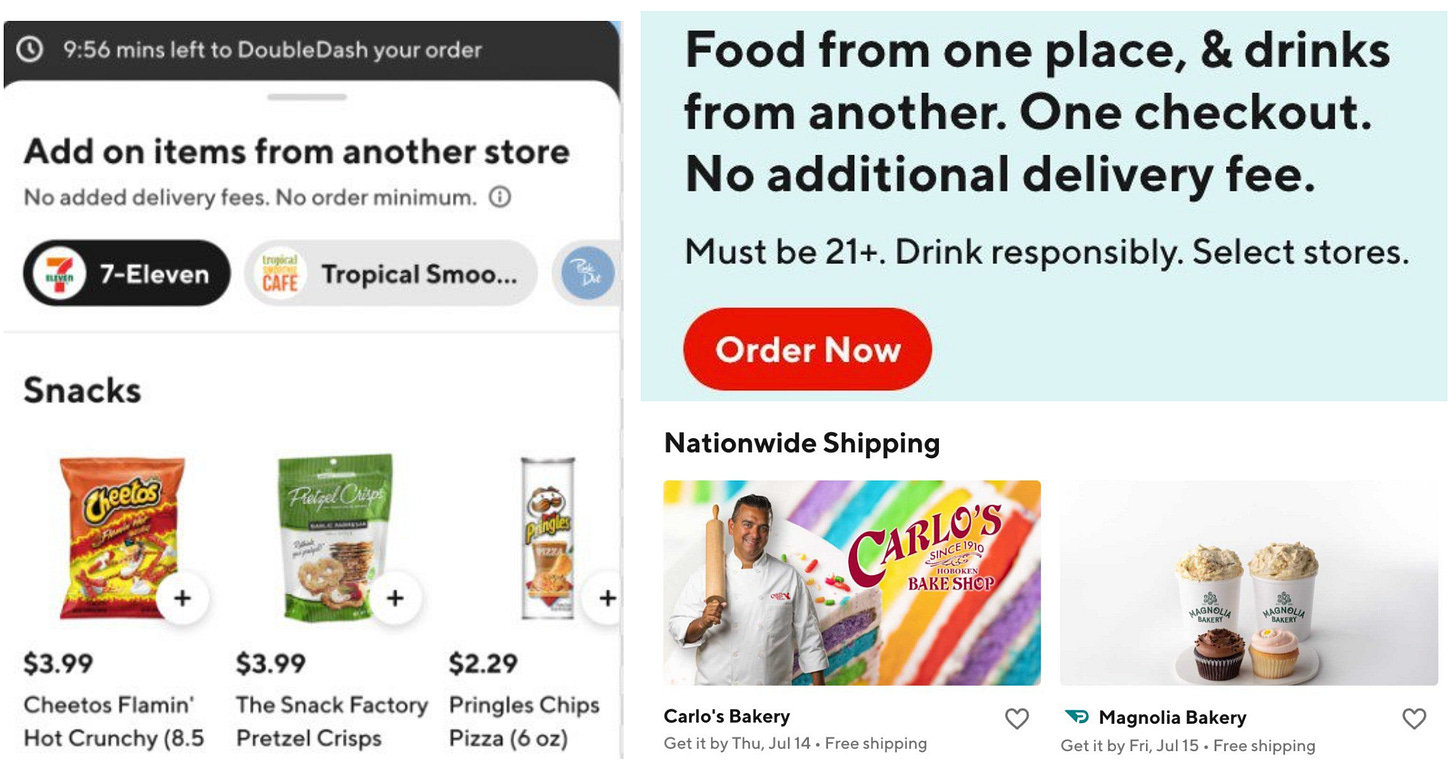

If you’ve been on DoorDash recently, you’ve probably seen that the company has moved beyond restaurant delivery. It’s now delivering items in categories like grocery, pharmacy, and retail - as well as offering nationwide shipping from iconic brands.

According to SecondMeasure credit card data, DoorDash had ~60% market share in U.S. food delivery as of May 2022, up from 35% in late 2019. This is a decisive lead - why wouldn’t DoorDash just focus on capturing the remaining share, or expanding globally? Why move beyond food delivery, which should have a massive TAM?

The underlying economics provide an answer! Gross margin (revenue - COGS) and contribution margin (revenue - COGS - other variable costs, including marketing) have been flat since 2020, when DashPass (the company’s monthly subscription for free delivery) took off. DashPass was a game changer, as subscribers order 50% more frequently. This increased local density and brought down marketing costs per order - flipping DoorDash from losing to making money on each transaction.

However, these margins are no longer improving with scale - and they may have hit a natural “upper bound,” at least for restaurant food orders. As of Q1 2022, DoorDash makes only $0.92 per order on a contribution margin basis. It’s hard to make much more than this on a $30 order (DoorDash’s AOV for restaurant delivery) when you have to pay both the restaurant and the Dasher.

Expanding into new categories seems like the obvious way for DoorDash to make more per order. The company has two main “levers”:

Increase order value: get customers to increase the value of what they’re buying on-app. This is where grocery, retail, and specialty items come into play, as these orders are often larger than the average restaurant ticket. Beyond new categories, DoorDash has introed features like adding items from nearby stores (DoubleDash), and prompting users to bundle food and alcohol.

Unlock higher margins: increase the “take rate” charged to the seller, or lower operational costs. This is where DashMart, DoorDash’s convenience stores, come in - the company can buy items at wholesale and sell them at retail. Non-restaurant categories may have higher take rates, as DoorDash likely won’t face fee caps that regulators have implemented for restaurants.

We’d love to hear your thoughts on DoorDash’s product expansion - have you ordered anything other than restaurant food on the app?

✅ Yes

❌ No

🤔 Not yet, but I would try it!

🚨 If you have 3+ years of experience and are looking for a biz ops role, check out Fleek! Fleek is a YC and a16z-backed company reinventing secondhand fashion via a wholesale B2B marketplace, and is hiring a biz ops lead.

jobs 🎓

a16z - Games Analyst (SF, LA, Remote)

Dragonfly Capital - Investor (SF, Remote)

Vial - Associate Product Manager (SF, Remote)

Twitch - Business Strategy Manager* (SF)

Alto Pharmacy - Chief of Staff to the Co-CEO (SF)

Heartland Ventures - Platform Associate (Columbus)

Activant Capital - Community Lead (NYC)

Blackstone Innovation Investments - Analyst (NYC)

Bain Capital Tech Opportunities - Analyst (Boston)

Calendly - Chief of Staff* (Remote)

*Expects 3+ years of experience.

internships 📝

Boom - Product & Ops Intern (Remote)

XRC Labs - Research Analyst Intern (Remote)

Grailed - Marketing Intern (Remote)

Vial - PM Intern (Remote)

Wyze Labs - BD Intern (Remote)

Cider - Marketing Intern (Remote)

EcoCart - Climate Research Intern (SF)

Techstars - Brand Experience Intern (SF)

Harper Wilde - Product Design Intern (LA)

Per Diem - BD Intern (NYC)

puppy of the week 🐶

Meet Sully, a two-year-old Irish Wolfhound who lives in Savannah, Georgia.

Sully is a therapy dog - when he’s not hard at work, his hobbies include hanging out in his yard and training to become an agility champion.

Follow him on Instagram @thesavannahwolfhound!

All views are our own. None of the above should be taken as investment advice. See this page for important information.