🚀 Who paid a $5M Bitcoin ransom?

Plus, sharing the results of our investing survey!

Forerunner Ventures released an interesting new report this week on how COVID has changed consumer behavior and attitudes. After surveying 1,000 consumers age 25+, the team outlined some of the trends that may persist in a post-COVID world. Check out the full report here - we’ve summarized some of the results below:

35% of respondents are more interested in working for themselves post-COVID - including 47% of parents with kids under 18 at home! The primary factor driving this was flexibility (which 59% of respondents cited).

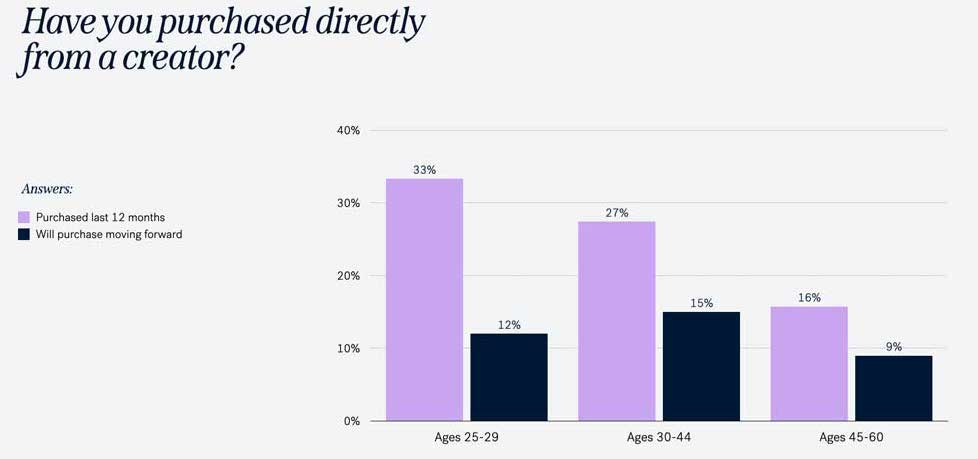

23% of respondents (and 33% of younger millennials) bought something from an influencer or creator in the last year. However, these are spontaneous purchases - most people say they aren’t specifically planning to make more going forward.

As the economy recovers and vaccines roll out, consumers are eager to resume travel. When asked how they’d spend extra money, 25% of respondents said travel - this was 3x higher than the next most popular category (except saving/investing).

news 📣

⛽ Colonial Pipeline pays ransom in BTC. Notice gas prices soaring this week? A ransomware attack that shut down Colonial Pipeline (the largest refined products pipeline in the U.S.) was to blame. The hacking group DarkSide was reportedly responsible - Colonial Pipeline paid $5M in Bitcoin to recover its stolen data and resume operations of its network. DarkSide, which has received $17.5M in Bitcoin ransoms thus far this year, now claims that it’s shutting down after being targeted by the U.S. government.

💰 Vitalik donates to COVID relief. Ethereum co-founder Vitalik Buterin donated over $1B to the India Covid Relief Fund and other charities. His donation came in the form of several dog-themed meme coins (e.g. SHIB, AKITA) that he had been gifted from the coins’ creators. Buterin, who is 27, became the youngest known crypto billionaire this month after the price of Ethereum surged.

In other crypto news, Tesla will no longer accept payments in Bitcoin due to environmental concerns. Elon Musk tweeted that he is working with the creators of Dogecoin to “improve system transaction efficiency" as a potential alternative.

🛴 Bird preps for public debut. E-mobility startup Bird (a CRV portfolio company) will be going public via SPAC at a $2.3B valuation. The pandemic hit e-scooters hard - Bird’s revenue fell 37% last year to $95M. However, the company’s pivot to a fleet manager model (where individuals earn money by managing 100+ scooters) notably improved the unit economics. Consumer demand is also beginning to bounce back, with 81% growth in gross transaction value over the past four weeks.

📊 Earnings updates. It was an exciting week for consumer tech earnings:

Airbnb had a strong Q1, recording 5% YoY revenue growth. The company’s core business is still recovering from the pandemic, but long-term rentals continue to be a bright spot - 24% of nights booked in Q1 were for stays longer than 27 days. Airbnb’s profitability fell sharply due to one-off items like debt repayment, restructuring fees, and a $113M impairment on office space in SF.

DoorDash (a CRV portfolio company) also exceeded expectations, doing $1.1B in revenue and nearly $10B in GOV (gross order value). The company’s order retention rate continues to exceed pre-COVID levels, and DashPass subscribers nearly doubled YoY. DoorDash struggled with an undersupply of Dashers, partially due to stimulus checks. Check out the company’s investor letter for more!

Coinbase continues to ride the wave of consumer crypto - the company did $1.8B in revenue and $771M in net profit in Q1. Almost all of Coinbase’s revenue comes from transaction fees on trades, so the company benefits when crypto markets are hot. The company announced that it will list dogecoin in the next 6-8 weeks.

As huge Sweetgreen fans (we’ve even been to the company’s test kitchen!), we were excited to see that one of our favorite salad chains is reportedly preparing to IPO. Sweetgreen was founded in 2007 and has raised a total of $671M, according to Pitchbook. The company has started expanding its product line to appeal to salad skeptics like Ron Swanson, with the launch of grain bowls in 2016 and Plates last year.

Pre-COVID, Sweetgreen was so popular among office workers that the company was testing free delivery to "Outposts” at corporate buildings. Sweetgreen even acquired a meal delivery startup in 2019. We’re interested to learn how the business fared during COVID - we’re guessing order volume shifted to delivery platforms like DoorDash.

what we’re following 👀

Meet Jennifer Daniels, the new head of the committee that picks which emojis we get.

Packy McCormick explains how we’re all playing the Great Online Game.

The Thiel Fellowship pays students to drop out - what’s its track record?

Casey Caruso on juggling a Google role and a VC gig at Bessemer at the same time.

Card issuing platform Marqeta filed to go public this week. We’ll cover the business in-depth when it IPOs, but summarized some fast facts from the S-1.

Last week, we asked you to fill out a survey about your investing habits - and you delivered! 72% of respondents were Gen Zers, and 90% had invested in at least one asset class. Some insights on your investing behavior:

Most popular brokerage - on average, you invest across 1.6 brokerages! 57% of you have a Robinhood account, and 37% use Coinbase. Of the “legacy” brokerages, Fidelity is in the lead (with 31%).

Portfolio allocation - only 14% of you use a robo-advisor. Of those of you investing on your own, you allocate on average 40% of your investments to individual stocks/crypto coins (vs. ETFs or mutual funds).

Dogecoin - nearly 30% of you have purchased Dogecoin, but half of you have since sold some or all of your stake! Most of you (64%) think Dogecoin won’t be a good long-term investment - 11% think it will be, and 25% are still undecided.

jobs 🎓

Human Capital - Associates (SF)

Atmos - Chief of Staff (SF)

Twitter - Strategy & Ops Associate (SF, Remote)

Streamlabs - Growth Marketing Manager (SF, Remote)

Robinhood - Benchmarking & Strategy Associate (Menlo Park)

Schematic Ventures - Analyst (Bay Area)

Citadel Defense - PM (San Diego)

Fractal - Engineers (NYC)

Nasdaq Ventures - Senior Analyst (NYC)

Overtime - Product Manager (NYC)

Lockstep Ventures - Associate (NYC)*

High Output - Chief of Staff (NYC, Remote)

March Capital - Associate (LA, Boston)

*Requires 3+ years of experience.

internships 📝

Atomic - Growth Marketing Intern (Remote)

Ohi - PM Intern (SF, LA, NYC)

SVB Capital - Credit Platform Investments Intern (Seattle)

Zendesk - Sales Ops Intern (SF)

Faire - Data Science Intern (SF)

Snap - Developer Relations Growth Intern (LA)

Boulevard - Operations Intern (LA)

Thrasio - Product Launch Analyst Intern (Salt Lake City)

OpenView - Investment Intern (Boston)

Drift - Brand & Comms, Content Marketing Interns (Boston)

DataDog - PM Intern (NYC)

Spotify - Content Strategy & BD Intern (NYC)

puppy of the week 🐶

Meet Basil, a 3-year-old beagle who lives in the UK.

Basil enjoys frolicking around in the woods (and taking pictures with flowers), hanging out at the beach, and making TikTok videos.

Check him out on Instagram @basil_the_beagle.uk!

Hi! 👋 We’re Justine and Olivia Moore, identical twins and venture investors at CRV. Thanks for reading Accelerated. We’d love your feedback - feel free to tweet us @venturetwins or email us at twins@crv.com.