🚀 Who will build the next Pokémon GO?

Plus, announcing an investment in a startup that makes real estate social.

It’s been a wild week for ConstitutionDAO, the crypto collective that raised $40M+ to buy a copy of the U.S. Constitution. After losing to Citadel CEO Ken Griffin, the organizers announced the project had come to an end and contributors could claim refunds in ETH (unfortunately, net of gas fees).

However, contributors could also chose to continue holding ConstitutionDAO’s token, $PEOPLE, or even sell it on various exchanges. This seemed to make little sense - if the project was dead, why would these tokens have any future value?

If we’ve learned anything from 2021, it’s that memes can now control markets (see GameStop and Dogecoin as examples). $PEOPLE has become somewhat of a meme token - it may not make rational sense to buy and/or hold it, but it represents the sentiment of a passionate community that believes in the Web3 movement.

In a fascinating turn of events, $PEOPLE traded up 30x+ this week. As of Saturday night, the coin had a $700M market cap! It’s almost a no lose situation for the original holders, who can redeem it at any time. But $PEOPLE still has room to climb if it maintains its meme status- $DOGE and $SHIB both have $20B+ market caps.

news 📣

It was a light news week due to Thanksgiving, but I’ll summarize the bigger headlines!

📱 AR platform Niantic (which made Pokemon Go) raised $300M at a $9B valuation. The company recently launched an AR Developer Kit, called Lightship, that allows others to build games and AR experiences using Niantic’s platform.

🤳 LTK (also known as LikeToKnowIt) raised a $300M round from SoftBank at a $2B valuation. The app allows influencers to post shoppable photos of their outfits, and make a 10-25% cut of any sales they generate.

🕵🏻♀️ Family locator app Life360 is acquiring Tile for $205M. Tile is known for its Bluetooth-powered tracking tags - it has recently faced fierce competition from Apple’s new AirTags and Samsung’s SmartTag+.

🛍️ After piloting a “Shop” module this summer, Twitter is moving further into social commerce. Walmart will use the platform to host a live shopping event (the first ever on Twitter!) today at 7pm ET - hosted by none other than Jason Derulo.

what i’m following 👀

BNPL apps are competing with store credit cards to capture holiday spend.

Chinese regulators have reportedly asked Didi to delist from the NYSE, citing concerns of data leakage.

Macy’s is auctioning off 10 Thanksgiving Day Parade NFTs.

Apple is planning to release an AR headset in 2022 - could it replace the iPhone?

🚨 New investment alert! 🚨

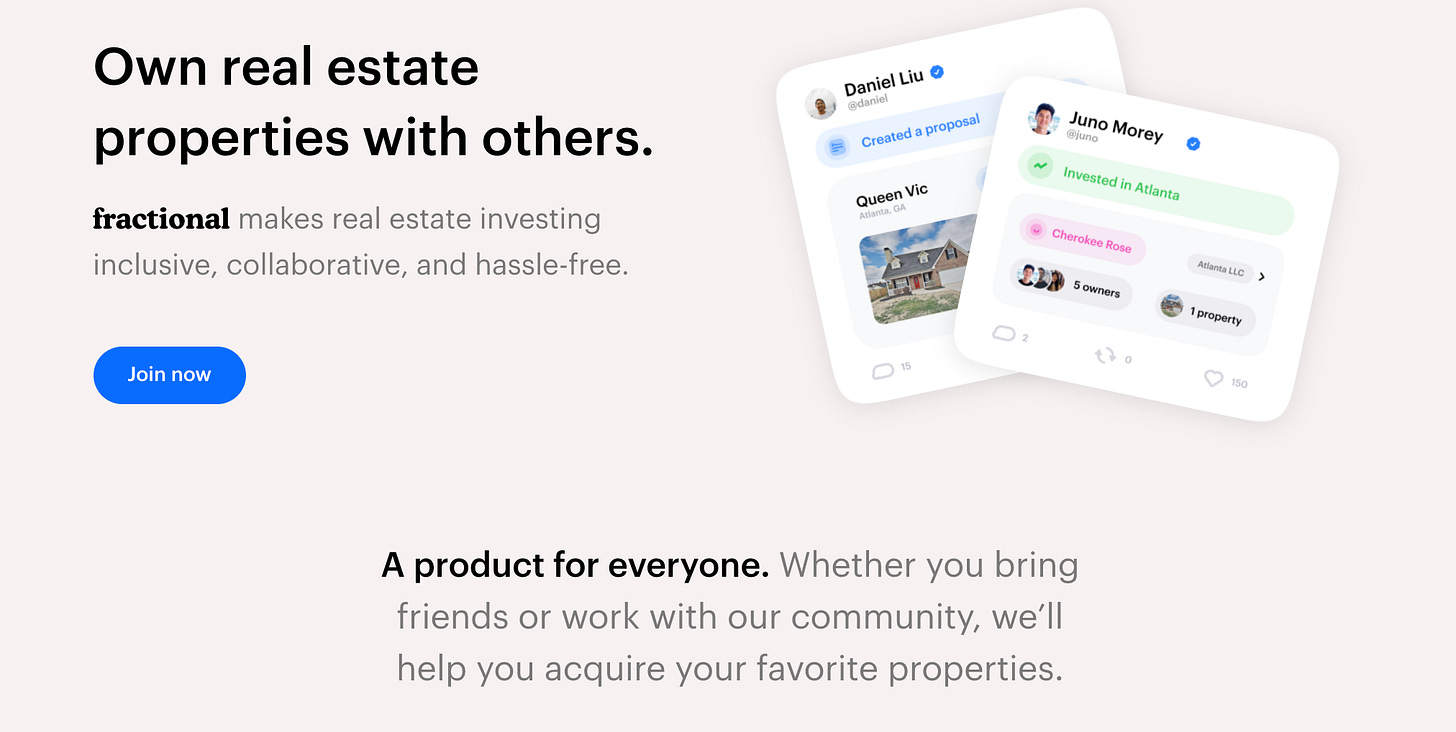

Fractional, which allows consumers to purchase and manage real estate properties collaboratively, announced a $5.5M seed round.

Co-founders Stella Han and Carlos Treviño started Fractional after meeting at BNPL startup Affirm. They wanted to create a more accessible experience in a space previously limited to the wealthy. Investing directly in real estate requires significant upfront cash (to buy the property) as well as time/expertise to find and underwrite a house, complete the legal process, and manage it post-purchase.

Fractional flips this process on its head! On the Fractional site, you can browse the company’s vetted listings, and create an investment proposal for friends to join. If you don’t have co-investors in mind, Fractional can help you find them. The platform takes care of the LLC formation, banking, financing, closing, and more - and post-purchase, helps you and your co-owners manage repairs, maintenance, and rentals.

The round was led by CRV (Olivia and I had a chance to partner with them there), and the company graduated from YC’s Winter 2021 class. So far, Fractional has helped more than 400 people invest in 95 properties - check it out here!

jobs 🎓

Slow Ventures - Principal, Creator Investments (Remote)

Chief - Core Ops Associate (SF, Remote)

Forward - Growth Ops Generalist (SF)

Tia - Director of Ops, Chief of Staff to the CEO (SF)

Rupa Health - Growth Analyst (SF)

Verkada - Associate Product Manager (San Mateo)

Unusual Ventures - Research Associate* (Menlo Park)

Robinhood - Financial Benchmarking & Strategy Associate (NYC)

Cedar - Associate Product Manager (NYC)

Titan - Investor Relations Associate, Crypto Investment Analyst* (NYC)

Parade - Ops Associate (NYC)

Noom - Corp Dev & Investor Relations (NYC)

*Requires 3+ years of experience.

internships 📝

Greylock - Marketing & Comms Intern (Remote)

Snap - MBA Content Strategy Intern (Remote)

Zendesk - PM Intern (Remote)

Atlassian - Sales Strategy & Ops MBA Intern (Mountain View, Remote)

Bill.com - PM Intern (San Jose, Remote)

Meta - Product Growth Analyst Intern (Menlo Park)

Abound - Ops Intern (LA)

Techstars - Founder Intern (Baltimore)

Addepar - Summer 2022 Community Marketing Intern (NYC, Remote)

Drift - Finance Intern (Boston)

puppy of the week 🐶

Congratulations to Claire, a four-year-old Scottish Deerhound from Flint Hill, Virginia.

Claire just became the first dog to ever win back-to-back “Best in Show” titles at the National Dog Show! When she’s not showing, Claire enjoys running through her backyard and napping.

Fun fact - Claire comes from a winning family! Her mom was second at the National Dog Show in 2015, and her grandmother won the title in 2011.

Hi! 👋 I’m Justine Moore, an early stage consumer & SMB investor. I’m currently Head of GTM at Canal. Thanks for reading Accelerated. I’d love your feedback - feel free to tweet me @venturetwins.