🎉 For the first time in four years, we’re expanding the Accelerated family with a second newsletter, Launched. We’re sending you the first issue, but make sure to subscribe so you don’t miss the next one. Olivia will be writing Launched every month, and she couldn’t be more grateful for your support.

Each issue will explore the launch story of a now-iconic startup, investigating the product & growth decisions that helped them break through the noise.

This week, we’re traveling back to early 2012. Almost no one had heard of an obscure cryptocurrency called Bitcoin, which you could buy for less than $10. Somehow, a new crypto trading platform managed to onboard thousands of users in its first few weeks, establishing a critical lead in what would become a multi-billion dollar market.

It was March 26, 2012. Brian Armstrong posted a self-described “hail mary” on the tech discussion forum Hacker News. YCombinator was interested in his startup, which Armstrong wrote “brings an emerging tech to the masses…and has a good shot at changing the world.” But he had a big problem - he didn’t want to go at it alone, and kept striking out on finding a co-founder.

After a year of meeting 1-2 candidates every week, Armstrong was desperate. He was looking for someone who was deeply technical, had an “insane” work ethic, and was up for doing something “super fucking hard.” And he had just three days to find this person before YC applications were due!

You may have heard this story before. Armstrong went on to build Coinbase, the crypto platform that went public this year. The Hacker News post I referenced went viral on Twitter around the time of the company’s direct listing.

But what you might not have heard is that Armstrong’s last-minute gambit actually failed. He did go through YC in the summer of 2012 - but as a solo founder. Armstrong didn’t find his co-founder Fred Ehrsam until months after graduating and closing a seed round. He did end up meeting Fred on a message board, but it wasn't Hacker News - it was on Reddit!

By then, Armstrong had already achieved a major milestone - publicly launching the product. When YC Demo Day rolled around, Coinbase had several thousand users and had processed $65K in transactions in the first five weeks. The company's user base was growing at an impressive 20% daily.

The success of this launch would be a huge feat for a team, let alone a single founder. How did Armstrong do it?

Three lesson we can learn from Coinbase's debut 👇

1️⃣ Read the room - and ride the wave. Spring 2012 was a fortuitous time for a new crypto trading platform. The second-largest bitcoin exchange, Trade Hill, announced in February that it was shutting down due to regulatory scrutiny. And other major exchanges Bitcoinica, Mt. Gox, and MyBitcoin had all experienced serious thefts, leaving thousands of users looking for a new (and safer) “home.”

At the same time, BTC transactions finally crossed 10k per day. Consumer demand was higher than ever, but many of the available trading platforms felt sketchy. Coinbase, in comparison, had immediate credibility - the company was helmed by a former fraud prevention exec from Airbnb and backed by YC.

Armstrong got the product out quickly - barely three months passed between his Hacker News post looking for a co-founder and the launch of the product. It was immediately public, with no closed beta. The product was raw - users were warned not to “use any coins with this website that you are unwilling to lose.” But this fast launch allowed Coinbase to capitalize on the flood of users leaving other platforms or getting into crypto for the first time.

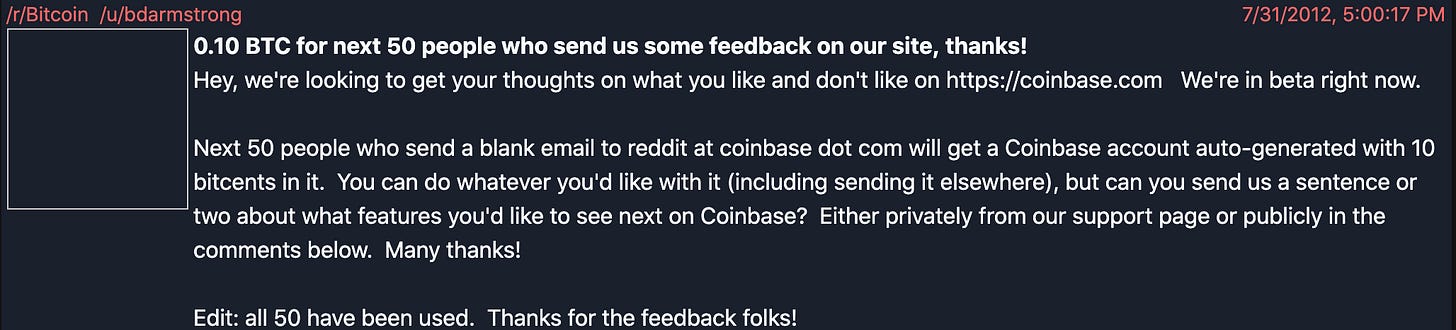

2️⃣ Focus on finding “your people.” Instead of launching with a TechCrunch feature or a tweetstorm, Armstrong posted announcements on Tumblr (where Coinbase’s blog lived until 2016), Hacker News, and Reddit - places where his target customer spent a lot of time! Reddit was a particularly important acquisition source, as the early crypto community congregated here. In a (now-deleted!) post on r/Bitcoin, Armstrong offered 0.10 BTC to users who emailed in feedback on the site.

The team also recruited early users by going directly to their inboxes with an offer they couldn’t refuse. Garry Tan recalled a cold email he received in the early days of Coinbase (when the company was still called Bitbank) that had 0.05 BTC attached - he just had to create an account to claim it.

3️⃣ Get your users to do your marketing for you. How did Coinbase grow from its first hundred users to the first thousand? The company created financial incentives for users to share the product. Coinbase’s first few cohorts received a referral link to give friends 0.10 BTC for signing up. For each friend that verified an account, the referrer also received 0.10 BTC.

With the price of Bitcoin around $10 at this time, this represented a $2 CAC (to pay for both sides of the referral). While small on an individual basis, it encouraged Bitcoin enthusiasts with large audiences to get the word out about Coinbase. And given the fact that Coinbase now sees average net revenue of $35+ per month for transacting users, a $2 CAC was a small price to pay!

Claiming this BTC required that a user add their phone number, email address, and set up a Coinbase profile. This made it much more likely a user got “hooked” on the product. Once they saw how easy Coinbase was to use, it was unlikely that they would immediately churn and send their Bitcoin elsewhere, particularly if that required setting up yet another profile.

The result? By the time YC Demo Day rolled around, Coinbase was already well on its way. Paul Graham’s reaction to Brian's August 2012 practice pitch says it all: "Holy shit, is this the first time I've seen your presentation? That was really good."

Remember to subscribe to Launched to get the next issue - and follow Olivia on Twitter @omooretweets for more startup stories!