🚀 Are you Super Pumped?

Plus, a new podcast recaps the week's Twitter drama 👀

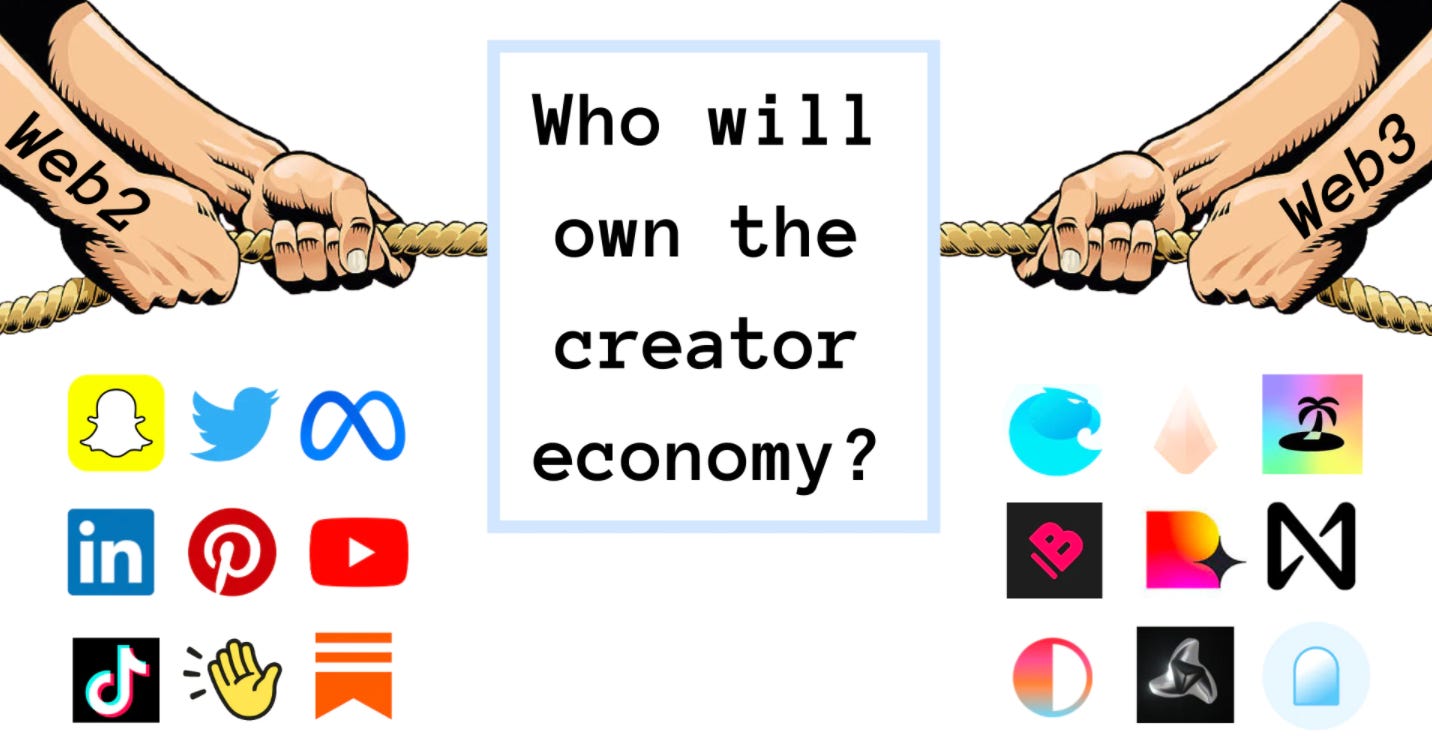

In case you missed it, I published some thoughts this week on the battle over the creator economy! The “hype” around the space may have died down over the past year - but I believe right now is the defining moment for how creators monetize.

Web2 social giants like Instagram and Twitter have finally woken up to the need to help creators make money. They’re launching monetization features (e.g. tips, subscriptions) at a rapid pace, while also giving away millions via “Creator Funds.”

Meanwhile, web3 offers a compelling alternative for creators to “own” their audiences. These platforms allow creators to avoid centralized moderation and keep most of what they make - but the UX is less user friendly and discovery is limited (for now!).

Check out the full blog post here - and I’d love to hear your thoughts in the comments or on Twitter.

news 📣

💰 Wealthfront finds an exit. UBS is buying robo-advisor Wealthfront for $1.4B, an acquisition intended to help the investment bank reach more millennials and Gen Zers. Wealthfront currently has almost 500k customers - CEO David Fortunato said that they should see “no change” to the user experience or cost of the Wealthfront product. The company’s last round in 2018 valued it at $500M.

🪙 Facebook winds down Diem. After three years, Facebook is reportedly shutting down its crypto product, Diem (formerly known as Libra). The company intended to build a stablecoin-based payments network, attracting PayPal, Visa, Stripe, and others as early partners. Diem never got off the ground after facing regulatory pushback due to concerns around data privacy and money laundering.

📈 Earnings updates. A few big earnings reports from this week:

Robinhood stock fell 15% after reporting declining crypto earnings and another drop in MAUs. The company also forecast a 35% YoY slide in Q1 revenue. Interestingly, the stock rebounded on Friday to end the week up 4%.

Tesla had a stronger quarter, outperforming on revenue and earnings. The company generated $17B in Q4 2021 revenue, and saw an increase in gross margin and a decrease in regulatory credits (which analysts see as positive).

Apple reported its highest-ever quarterly revenue of $124B, as sales of almost every product beat expectations despite supply chain issues in December. The stock saw its largest single-day jump since July 2020, up 7%!

This week, we got an early look at Showtime’s “Super Pumped” - a limited series based off of Mike Isaac’s book about the rise of Uber and eventual ouster of Travis Kalanick. The show will premiere on February 27.

Like any good trailer, it amps up the drama! Given the Uber IPO was relatively recent, it’s kind of crazy to see A-list talent portraying tech execs (and VCs!) that are still very much “in the game” - it should be an interesting watch 😎

what i’m following 👀

Fashion Nova will pay $4M for blocking negative reviews - the first fine of its kind.

Logan Bartlett, Nikita Bier, and Zak Kukoff launched a podcast recapping the weekly tech Twitter drama - check it out here (could they have picked a better first week?)

NBC will partner with TikTok for the 2022 Winter Olympics!

The NYT profiles Thursday, a dating app that operates one day a week.

I want to preface this by saying I’m a big fan (and customer) of Glossier, and want it to succeed! But as someone who works in e-comm infra, I think this news spurs valuable conversation about what drives value in D2C brands.

This week, beauty startup Glossier laid off 80 employees, most of whom worked on the tech team. CEO Emily Weiss said she overhired for “certain strategic projects that distracted us from the laser-focus we needed to have on…scaling our beauty brand.”

From an outsider’s perspective, Glossier seems to be doing well. The company raised an $80M Series E at a $1.8B valuation in July 2021, a markup (though slight) from its last round in 2019 at $1.2B. I don’t see this as anything close to a death knell for the company - but it’s a moment emblematic of a broader trend within D2C.

The initial thesis behind the surge of VC-backed D2C brands in the mid-2010s was that CPG companies could unlock software-like returns by eliminating “middlemen” and leveraging technology to make operations more efficient. A crucial part of this was selling through their own websites & social channels - eliminating the need for physical stores or third-party retailers (which take a meaningful cut).

Has this played out? The early D2C giants, some of which have IPO’ed (e.g. Warby Parker, Casper, and Allbirds) have struggled to become profitable and likely aren’t thrilled with the reception from public investors. And as acquisition costs rise on platforms like Instagram, brands have been pushed back into the traditional channels that they were aiming to disintermediate.

Glossier is one such brand returning to physical retail - after shuttering all locations during the pandemic, the company opened permanent brick-and-mortar stores in Los Angeles, Seattle, and London over the last few months. However, the brand still doesn’t sell any products through traditional retailers like Ulta and Sephora.

Glossier has also invested heavily in technology, building its own commerce APIs and a proprietary point-of-sale system. But was it necessary for the company to develop these features internally instead of partnering with external providers? Maybe not.

As beauty experts have pointed out, Glossier popularized the “no-makeup makeup” aesthetic - but it’s now facing heavy competition. Brands like Rare Beauty, Kosas, and Milk Makeup have made significant inroads, particularly among Gen Z consumers.

I’m still bullish on Glossier’s future, and I’d love to see the company solidify its market share by doubling down on product quality and distribution (maybe even offering some SKUs through traditional retailers?). Would love to hear any ideas you have for Glossier - comment ⬇️ to let me know!

jobs 🎓

A* Capital - Investment Associate (Remote)

Contrary Capital - Investment Associate (Remote)

20VC - Head of Content (Remote)

Calm - Consumer Growth PM (Remote)

Coinbase - Product Manager, NFTs (Remote)

Dapper Labs - Business Associate (Remote)

Initialized Capital - Associate (SF)

Dorm Room Fund - Director of Ops & Community (Remote)

a16z - “American Dynamism” Deal Partner (Menlo Park)

Captain Experiences - Head of Growth Marketing, SEO Specialist, UI/UX Designer, Back End Developer, Front End Developer (Austin)

FirstMark Capital - Talent Associates (NYC)

Tusk Venture Partners - Associate (NYC)

internships 📝

Outer - Growth Marketing Intern (Remote)

GGV - NextGen Fellows (Remote)

Reddit - PM Intern (Remote)

a16z - Summer Intern (Remote)

Blind - Marketing & Growth Intern (Remote)

Descript - BD Summer Associate (Remote)

Zoom - PM Intern (Remote)

TheRealReal - MBA PM Intern (Remote)

Amplitude - PM Intern (Remote, SF)

Lyft - Content Design Intern (SF)

Uber - MBA Eats for Business Intern (SF)

Disney - Accelerator Intern (LA)

puppy of the week 🐶

This week, we’re asking for your help! Sylvia and Iyah Romm of Cityblock Health are missing their newfoundland, Quinn, who was last seen in the Charleston, SC area.

Quinn is 105 pounds and black and white - she’s extremely friendly. Please contact 617-233-2671 or 7688221@pawboost-mail.com if you see her, and spread the word to friends in Charleston!

Hi! 👋 I’m Justine Moore, an early stage consumer & SMB investor. I’m currently Head of GTM at Canal. Thanks for reading Accelerated. I’d love your feedback - feel free to tweet me @venturetwins.